USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Analysis – September 15

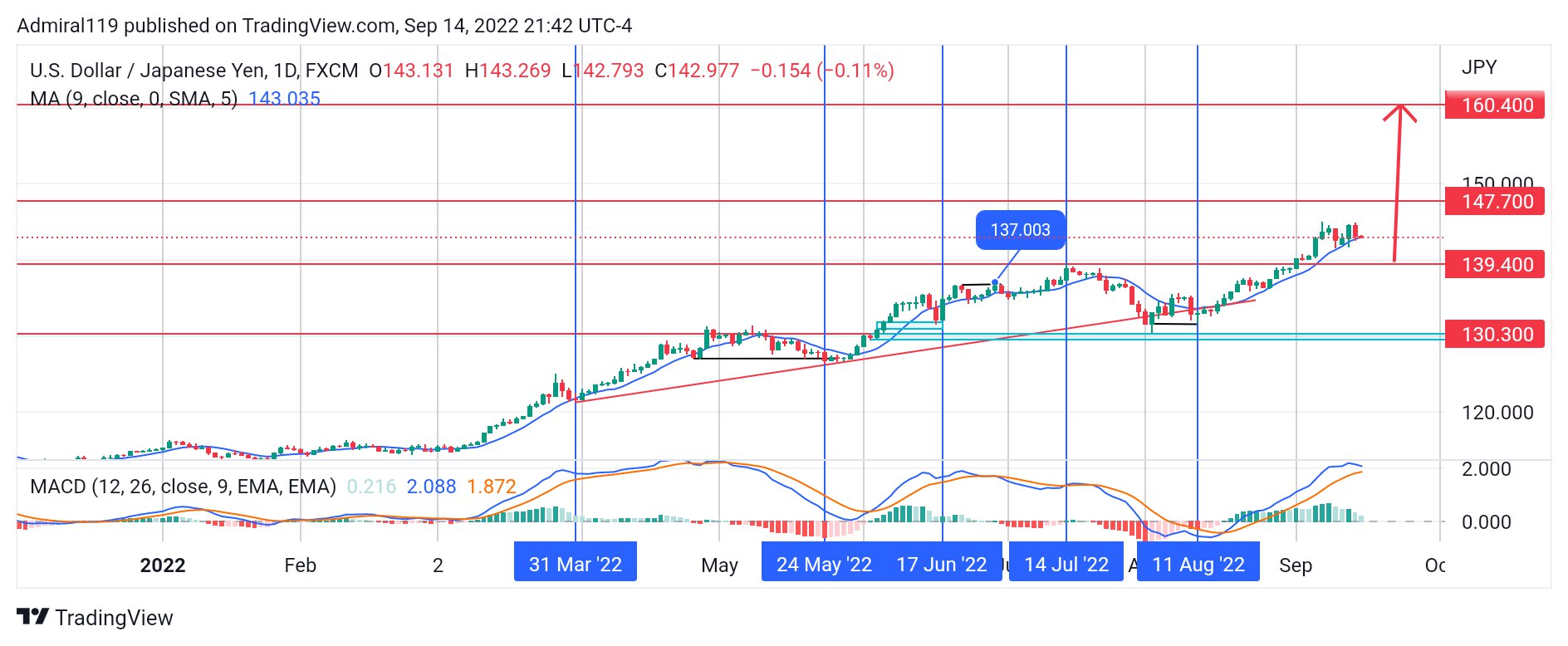

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Buyers Resume the Market Trend to the Upside. The Daily Chart Moving Average (Ma) Has Been Moving Steeply for a Very Long Time as the Bulls Continually Drive Prices Upward. The Market Is Extremely Bullish as It Breaks Every Resistance on Its Path Upward. This Aggressive Bullishness Shows How Weak the Japanese Yen Is Against the US Dollar.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Significant Zones

Demand Zones: 139.40, 130.30

Supply Zones: 147.70, 160.40

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long-Term Trend: Bullish

On the 31st of March, 2022, the Usdjpy Buyers Resumed the Market Trend as They Began to Respect the Diagonal Trendline Support to the Upside. This Impulse Wave Was Faced With Previous Resistance at 130.30. The Previous Wave Crashed the Market to the Downside, Sweeping off the Liquidity Below the Previous Low Before Bouncing off the Diagonal Trendline Support. The Moving Average Convergence Divergence (Macd) Indicator Revealed How the Market Rallied to the Upside in the First Two Weeks of June.

On the 17th of June, 2022, the Usdjpy Buyers Resumed the Market Trend to the Upside Again After Using the Immediate Fair Value Gap as Their Expansion Level. On the 14th of July, 2022, the Market Cleared Out the Liquidity Formed Above the Double Top in June Before Crashing Downward. The Market Kept Crashing Downward Until Prices Hit the Order Block Formed on the 2nd of June. The Order Block Alongside the August Open Level Was Used to Drive the Market to the Upside.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-Term Trend: Bullish

On the 11th of August, 2022, USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Buyers Used the Four-Hour Fair Value Gap (Fvg) To Expand the Market to the Upside. Ever Since Then, the Market Has Been in an Uptrend. Recently, a Double Top Was Formed on the Four-Hour Time Frame. This Double Top Should Have Large Sell Orders (And Buy Stops) Placed Just Above It. These Buy Stops, or Liquidity Pool, Are Expected to Be Swept off Soon by the Bulls Before Resuming the Market Trend to the Upside.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.