USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Analysis – November 24

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers prepare for entry around the diagonal support. Amidst the USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers’ dominance in the market, the USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade sellers were successfully able to find a proper entry at a major level in the market. However, the bearish season seems to be coming to an end as the price approaches the major diagonal support.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Significant Zones

Demand Zones: 130.40, 126.40

Supply Zones: 145.10, 151.90

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long-term Trend: Bullish

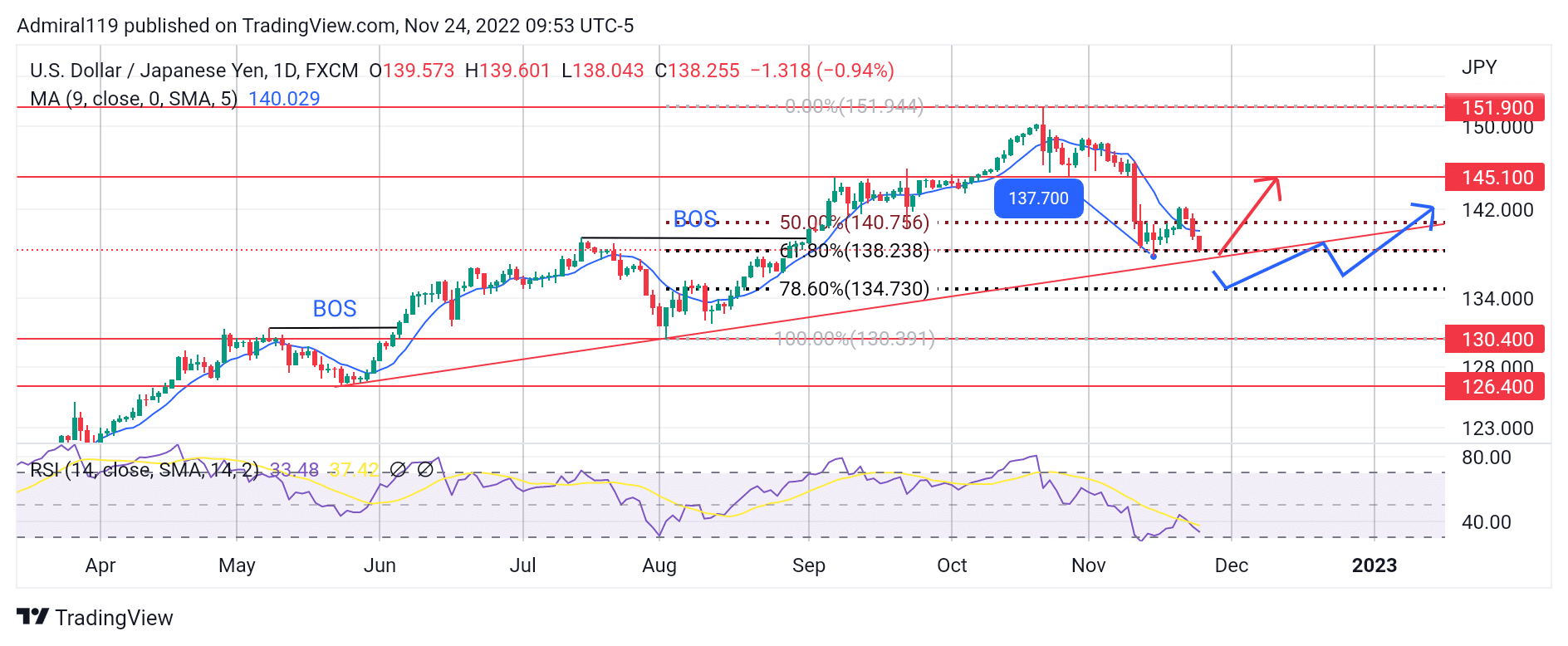

Even with the current bearish move, the market’s overall direction remains bullish on the higher time frames. Beginning with the rejection of the price at the 126.40 support, the major diagonal support emerged at the swing low, which was formed in May 2022. In its entirety, the diagonal support rose upward, resisting further price declines at the swing lows in favor of USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers. The overall bullishness of the market is characterized by the subsequent breaks in structure to the upside.

A similar incident that happened on May 26, 2022, also happened on the second trading day of August 2022. Price bounced rapidly and with great momentum to the upside after the confluence of the diagonal support and the horizontal support at the 130.40 price level occurred. A few days later, the USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers took partial profits, and the market eventually crashed down due to the selling pressure at the 151.90 resistance. The market is currently seeking sell-side liquidity below the previous low.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-term Trend: Bearish

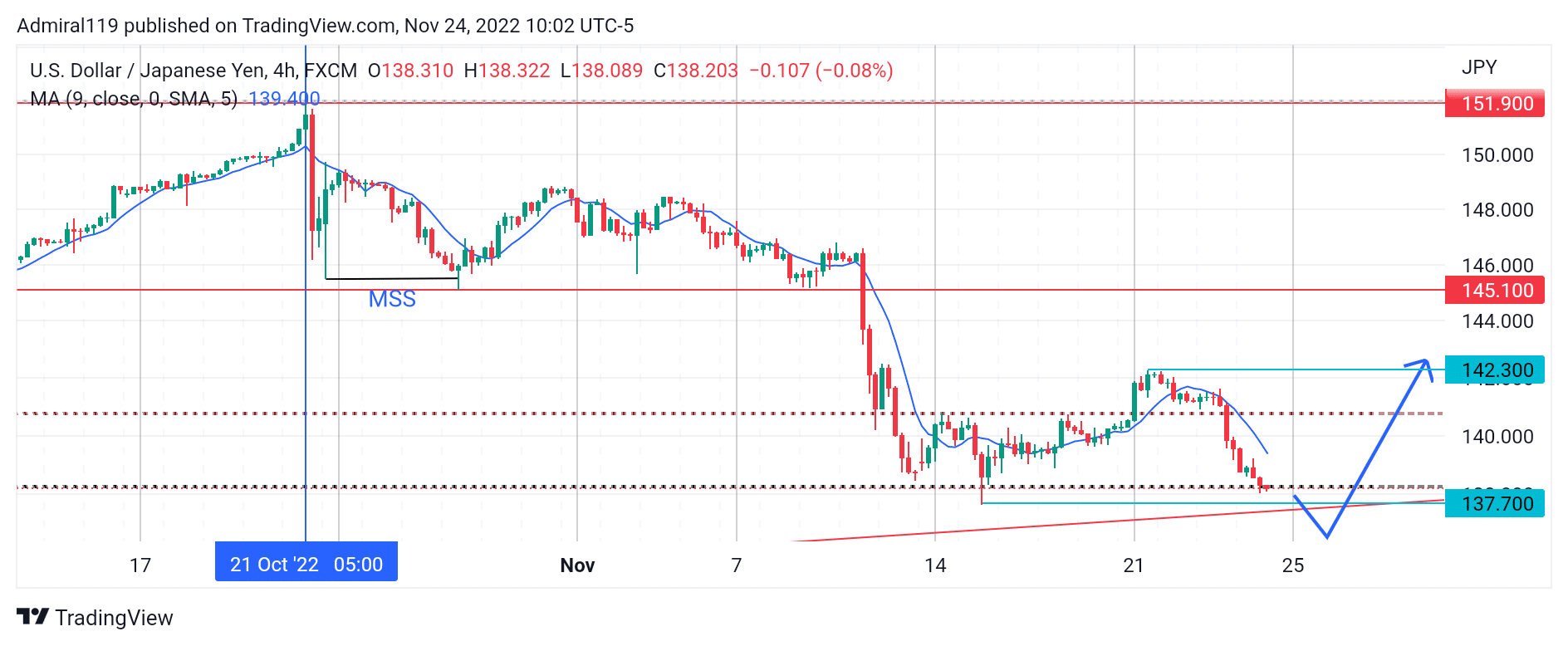

On October 21, 2022, the market swerved downward on the four-hour chart to shift the structure of the market to the downside. After the market structure shift (MSS), prices began to sink lower and lower, into a discount. Once the sell-side liquidity is grabbed, USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers are expected to take control of the market once again.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.