USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Analysis – November 17

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers finally resume the uptrend after a discount. Up until late October this year, USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers had been in absolute control of the market. Though the market’s order flow is still bullish, the USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade sellers have been having a nice moment in this current phase.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Significant Zones

Demand Zones: 139.40, 135.50

Supply Zones: 145.10, 151.90

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long-term Trend: Bullish

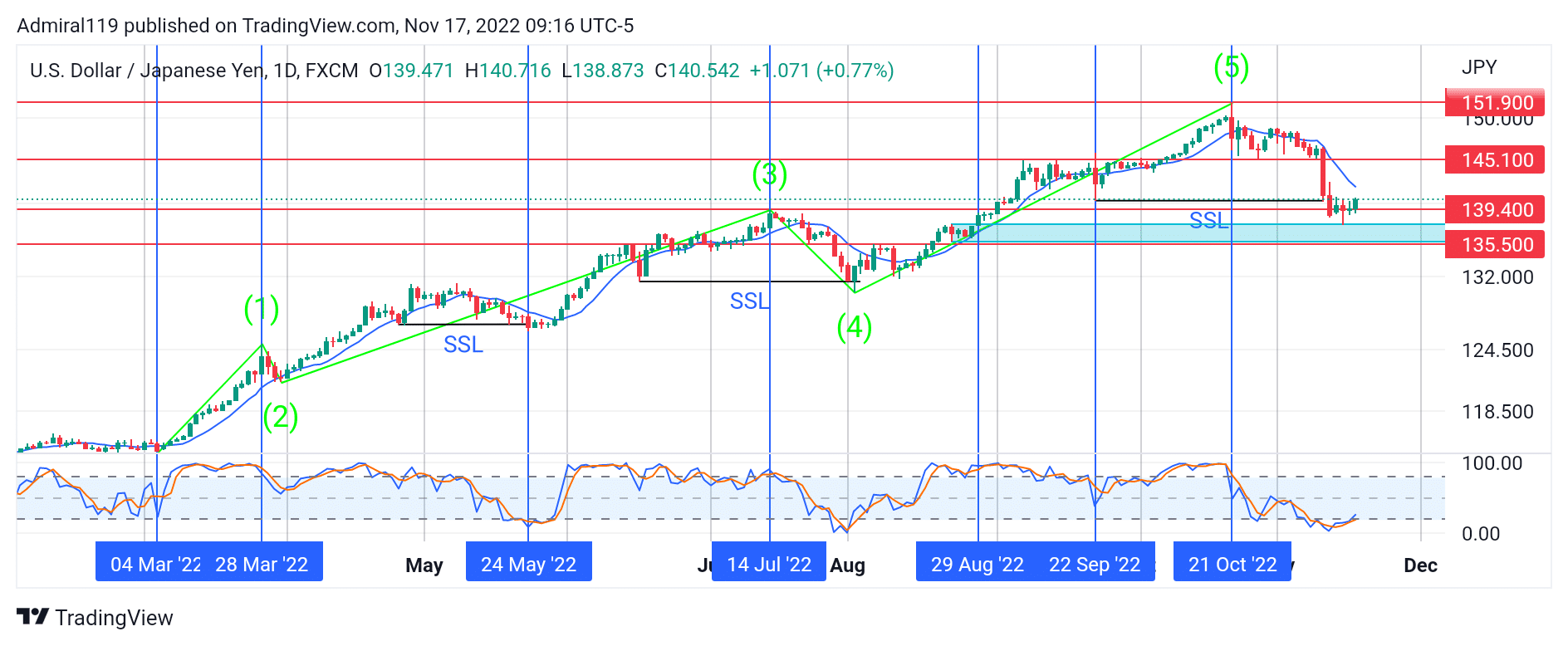

The market has completed its upward wave. USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade seems to be in a correction phase now as it prepares for the next major wave, either to the upside or the downside. The motive wave emerged from a consolidation phase, and since then, the USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers have been gallivanting upward as the bears became so fearful to storm the market.

The breakout from the consolidation phase happened on March 4, 2022. The price rallied from here into the peak of the first wave, which was on March 28, 2022. Without budging, the bulls stormed the market again. The third impulse leg, which appears to be the longest impulse leg in the market, had its moments for about four months before correcting to the downside. On August 29, 2022, the USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers drove the price upward. A bullish order block was created in this movement as the price continued into the supply zone at 151.90. The market does seek sell-side liquidity (SSL) before making a notable expansion to the upside. From the supply zone of 151.90, USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade sank deeply into the discount zone to hit the bullish order block.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-term Trend: Bearish

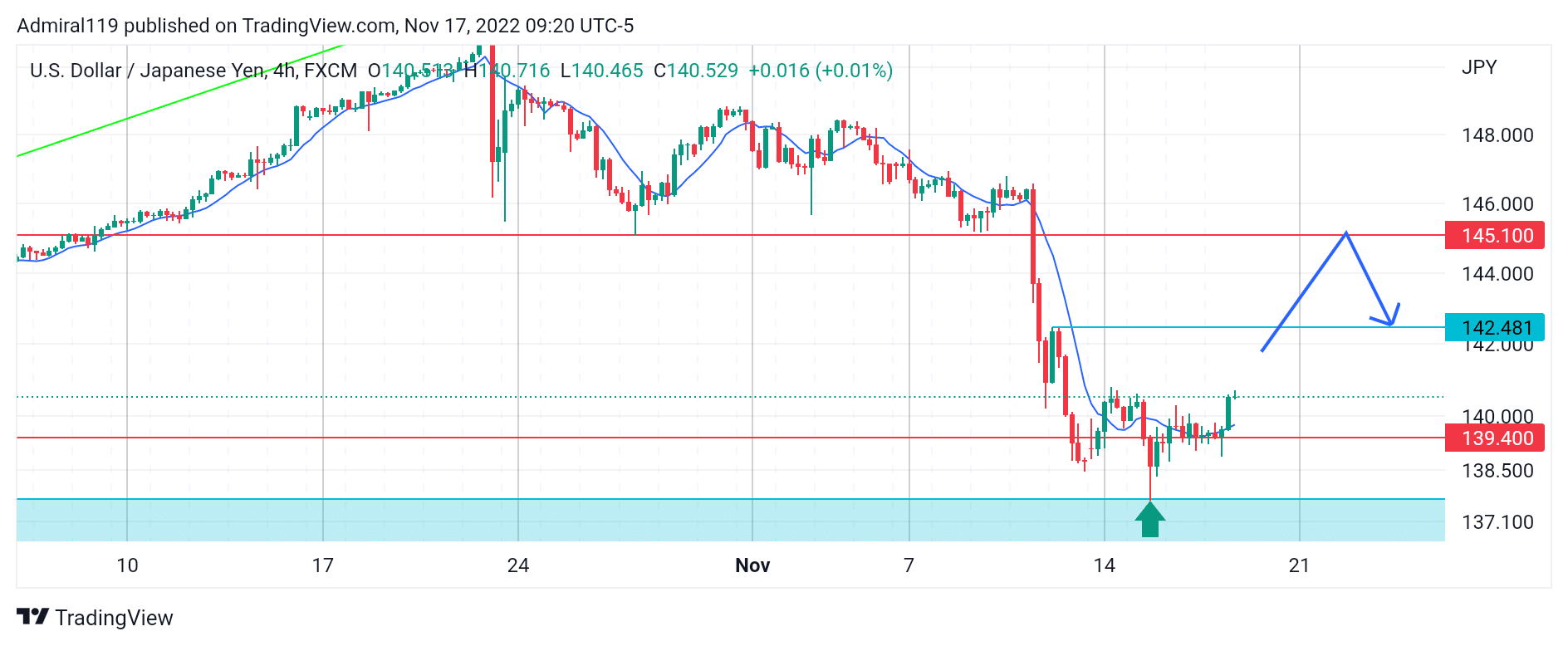

Since USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade completed the fifth impulse leg, the market has been in downtrend on the four-hour chart. Following a subsequent break of structure to the downside, the market entered the discount zone and grabbed sell-side liquidity (SSL). An expansion to the upside is expected to begin from here until the 145.10 resistance is reached.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.