USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Analysis – November 10

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade bears finally dominate the market as price heads into the discount zone. The market had been extremely bullish for a very long time, until recently, when the bears decided to take over.

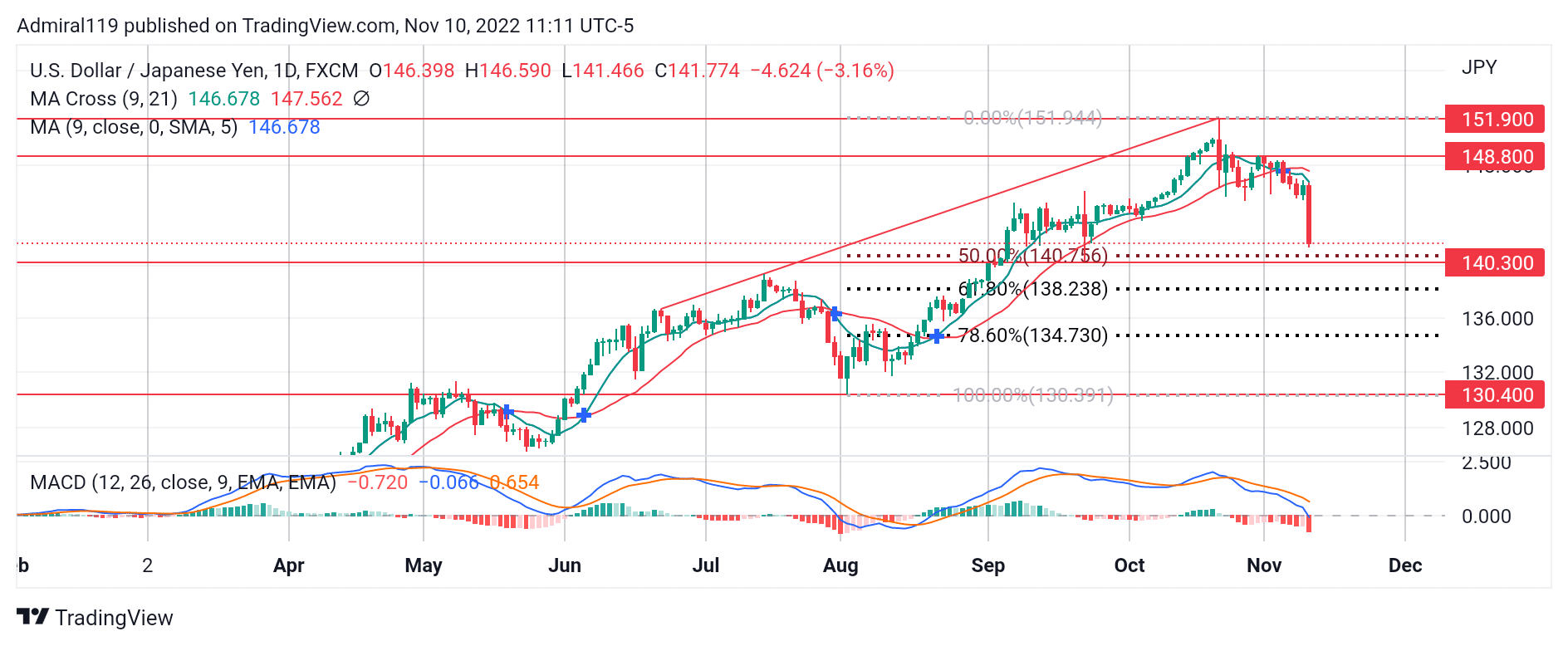

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Significant Zones

Demand Zones: 140.30, 130.40

Supply Zones: 148.80, 151.90

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long-term Trend: Bullish

Amidst the bullishness of the market, the bears stealthily found an entry at major resistance. While the chances given to the bears were pullbacks, the bears remain persistent at every major zone and level. Just before June 2022, when the 130.40 major level was struck and broken by the bulls, USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade was randomly moving below with little momentum. A final strike on the level in June crushed out the bears as the price surged upward in a sloppy uptrend. While the bulls seemed to be taking the market upward with no chance for a retracement, a diagonal resistance emerged and limited their potential.

Though the potential of the bulls was reduced by the diagonal resistance, the bulls remained in total control of the market. At the second attack by the bulls on the diagonal resistance, the selling pressure at the point overwhelmed the bulls as they retreated until the 130.40 support was reached.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade beat a retreat at this point as the bulls had already placed a large volume of buy orders therein. With more confidence and enthusiasm, the bulls drove prices upward and upward until the 151.90 supply zone was reached. The 130.40 and 140.30 levels serve as the low and high of the current trading range.

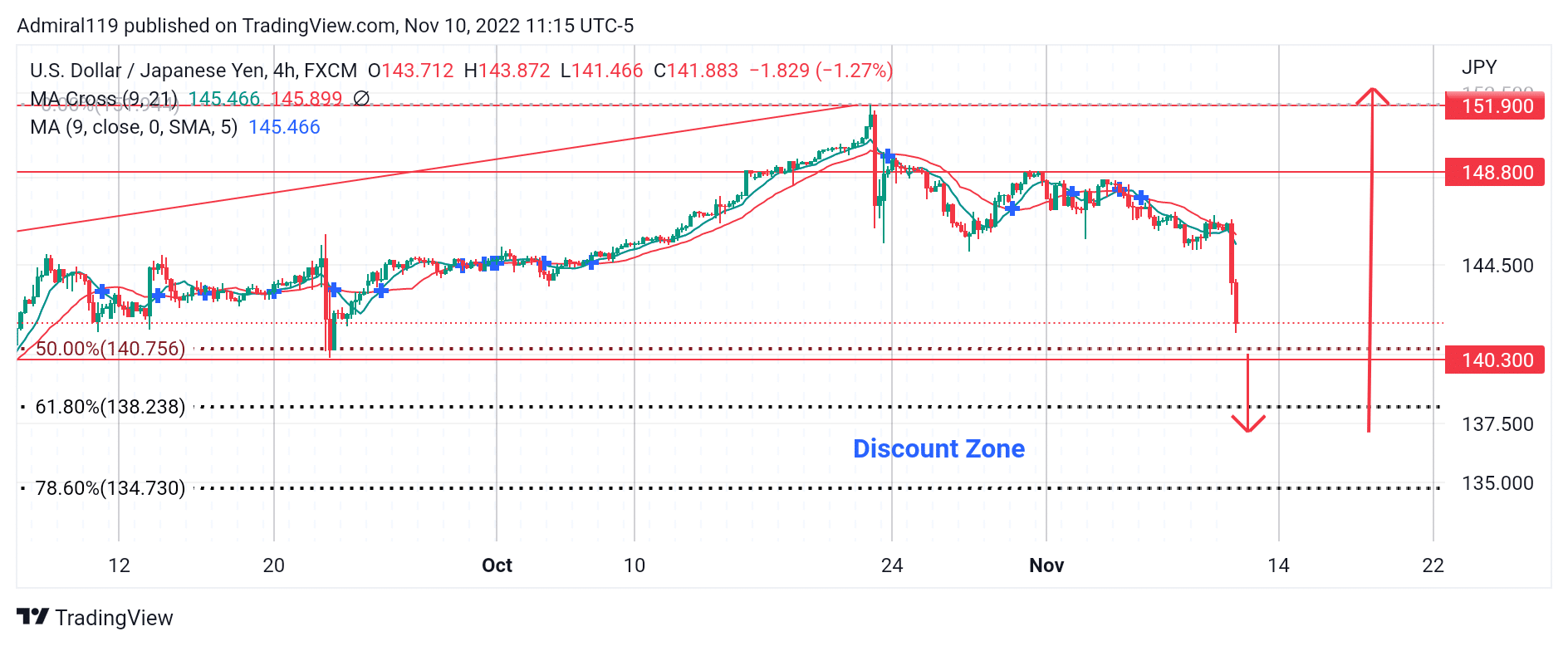

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-term Trend: Bearish

The outlook for the market is bearish on the four-hour chart. The USD/JPY appears to be moving into the discount region. It is anticipated that the bulls will enter this discount zone and likely resume the market’s upward trend.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.