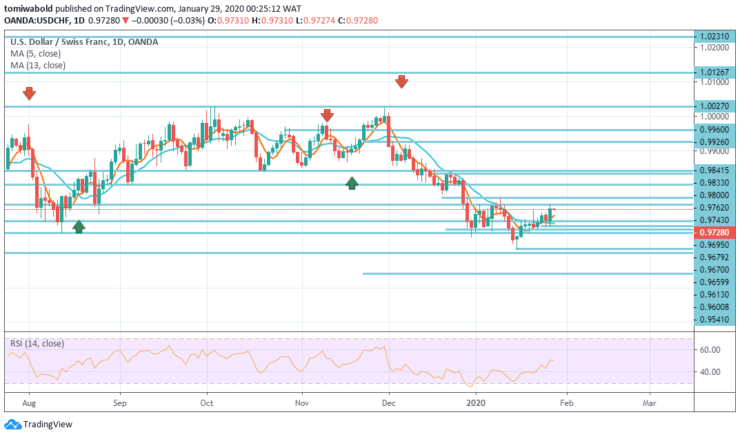

USDCHF Price Analysis – January 29

USDCHF challenges gravity in a series of consecutive daily gains within its rise from its lowest on December 31 and this despite the lowest levels in the ten-year Treasury yield since October 9 last year. Markets fear the spread of the Coronavirus and the threat of infection in global financial markets.

Key Levels

Resistance Levels: 1.0231, 1.0027, 0.9762

Support Levels: 0.9659, 0.9613, 0.9541

USDCHF Long term Trend: Ranging

In the larger structure, the long-term trend remains neutral as USDCHF trades sideways while trading from the level of 1.0231 (high). The fall from the level at 1.0231 is the part inside the pattern and might target the level at 0.9600 (low).

In the case of another rally, a break of 1.0231 level is required to signal a continuation of the bullish trend. Otherwise, more sideways trading may be seen with another downside risk.

USDCHF Short term Trend: Ranging

The medium-term bias in USDCHF stays also neutral for the time being. The consolidation may extend from 0.9613 level, but the upside may be contained by the resistance of 0.9762 levels to halt the trend continuation. Beneath 0.9659 level, minor support may usher in the 0.9613 level retest on the low. The breach may target 100% expectations from 1.0231 level to 0.9659 from 1.0027 at 0.9541.

Meanwhile, given the bullish pattern of the RSI on the 4-hour chart, a break of 0.9762 level may indicate a short-term reversal and alter to the upside for a stronger bounce near term barrier (now at 0.9800 level).

Instrument: USDCHF

Order: Buy

Entry price: 0.9679

Stop: 0.9659

Target: 0.9762

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.