USDCHF Price Analysis – February 18

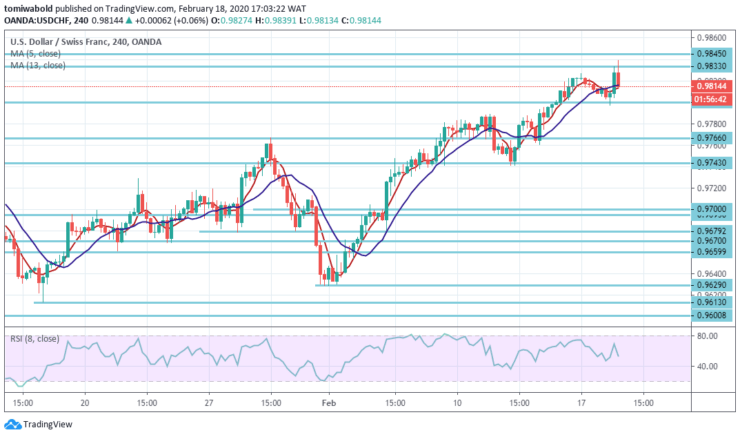

The USDCHF pair swiftly regained some 15-20 pips from the lows of the early European session to the American session and is currently in neutral region, slightly past 0.9800 level.

Key Levels

Resistance Levels: 1.0231, 1.0027, 0.9841

Support Levels: 0.9800, 0.9743, 0.9613

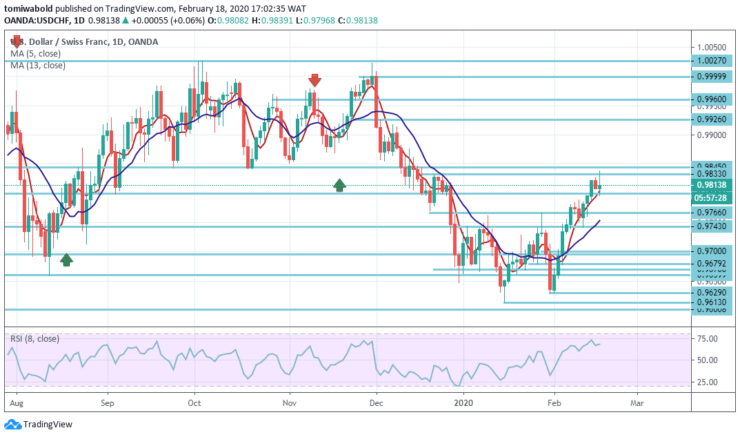

USDCHF Long term Trend: Ranging

In a broader trend, the general direction stays neutral, since the USDCHF is in a range trading which began from 1.0342 (high). The decline from the level of 1.0231 is part of the model and may approach 0.9600 (low).

In case of further progress, a breakthrough in the level of 1.0231 is necessary to indicate the resumption of an uptrend. Contrarily, further trading by the range may be registered with the risk of another plunge.

USDCHF Short term Trend: Bullish

After a short retreat, USDCHF growth from 0.9613 level resumed, and the intraday bias returned to the upper zone. Initially, attention is paid to the retracement from 1.0231 to 0.9613 at 0.9851 levels. A decisive breakout there may add to the bullish short-term reversal and target pullback of the pair at the next 0.9999 levels.

Regardless, a deviation to the level of 0.9841 may indicate that the plunge from the level of 1.0231 is not completed. Breakout of the support level of 0.9743 may lead to repeated testing of the low level of 0.9613.

Instrument: USDCHF

Order: Buy

Entry price: 0.9800

Stop: 0.9766

Target: 0.9845

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.