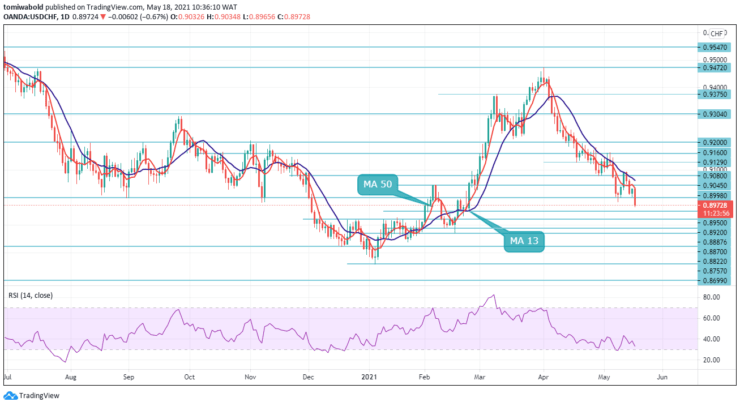

USDCHF Price Analysis – May 18

Early in the European session, the USDCHF pair slips beneath 0.8998 to multi-month lows, with sellers now looking to expand the downward trend below the 0.8950 low level. The decline was fueled solely by sustained US dollar sellers, as Investors’ risk aversion boosts demand for safe-haven Franc.

Key Levels

Resistance Levels: 0.9304, 0.9160, 0.9045

Support Levels: 0.8950, 0.8887, 0.8757

The USDCHF was hit by fresh selling at the start of the day at 0.9034, and it proceeded to fall due to broad-based USD weakness on risk sentiment to an intraday low of 0.8965 at the time of this post. The present bias stays on the downside towards breaching the horizontal support at $0.8950.

In the event of a second rebound, the upside of the USDCHF may be limited by the 0.8998 support turned resistance level, signaling the start of a new decline. In any case, a break of 0.9000 marks is required to signal medium-term bottoming. Otherwise, the trend may stay bearish in case of a rebound.

The USDCHF is now trapped beneath a temporary peak of 0.9034 and continues to fall. The initial intraday sentiment is bearish. If there is another turnaround, the 0.8998 former support level, which has now turned into a resistance level, signaling the start of a new decline, should limit upside potential.

On the downside, if the 0.8950 level is breached, the 61.8 percent projection of 0.9164 to 0.8998 levels from 0.9093 at 0.8950 levels could be targeted next. Marginal weakness is expected as long as the 0.8998 level persists, but the 0.8950 level is likely to hold. Just above the 0.8998 level is there a chance of a move towards the 0.9045 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.