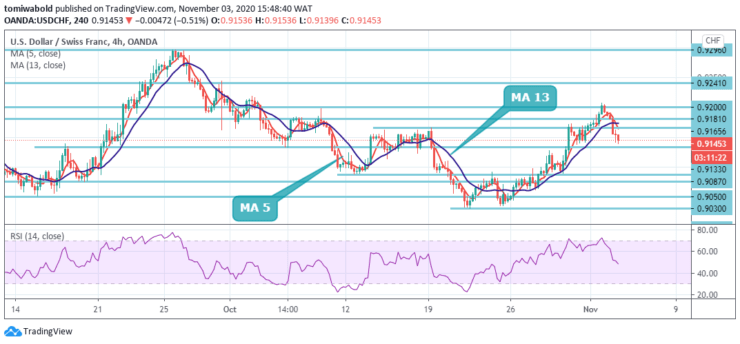

USDCHF Price Analysis – November 3

The US Dollar has plunged by 0.47% against the Swiss Franc since the beginning of the day. Given that a breakout has occurred, sellers are likely to pressure the exchange rate lower while extending the downside bias during the following trading session. The downfall was sponsored by some aggressive US dollar long-unwinding trades and US election day.

Key Levels

Resistance Levels: 0.9296, 0.9241, 0.9165

Support Levels: 0.9087, 0.8998, 0.8746

All things being equal, the USDCHF exchange rate may continue to decline over the next trading sessions. The potential target for bears is around 0.9075. However, the previous week’s support at 0.9087 could provide a temporary basis for the currency’s exchange rate during this week’s trading sessions.

In a broader context, the decline from 1.0231 is seen as the third phase of the trend from 1.0342 (high). There are no clear signs of completion yet. On resumption, the next target is 138.2% forecast from 1.0342 to 0.9181 from 1.0231 at 0.8746 levels. However, a strong breakout of the 0.9296 resistance level would be an early sign of a trend reversal and would look to the key resistance at 0.9902 for confirmation.

USDCHF is still expected to plunge further with support at 0.9133. The current rally from 0.9030 is seen as the third phase of the trend from 0.8998. The intraday trend is up towards the 0.9296 resistance level.

The breach may approach the 38.2% recovery from 0.9902 to 0.8998 at 0.9362. On the other hand, a break of the minor support level of 0.9133 would lead to a downward bias towards the support level of 0.9030. At the moment, the USDCHF pair still seems vulnerable to further slide and a desire to return to the 1.3100 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.