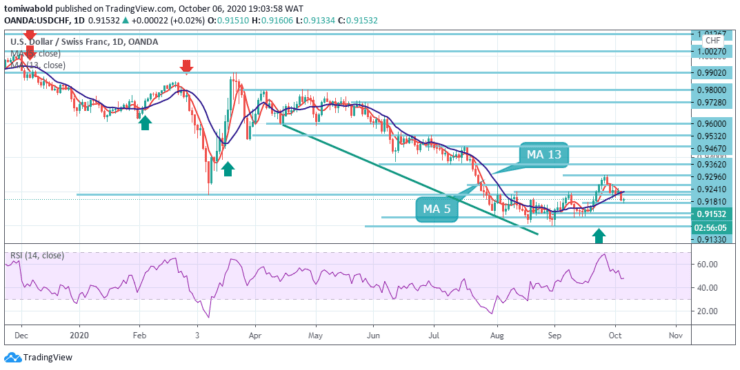

USDCHF Price Analysis – October 6

The selling pressure surrounding the greenback at the start of the week seems to be causing USDCHF to stay under selling pressure. USDCHF downside momentum attacks 0.9133 level during the American session on Tuesday. In doing so, the pair alternates near retracement of late-September as US Dollar Index (DXY) extend the slide.

Key Levels

Resistance Levels: 0.9600, 0.9467, 0.9296

Support Levels: 0.9133, 0.9075, 0.8998

USDCHF Long term Trend: Bearish

As seen on the daily chart, the pair’s failure to rebound off the subsequent support level of 0.9133 may have another shot as the high and lower line of the declining gradient of September 17, near the level of 0.9133, becomes the hard target for sellers to smash.

On the other hand, if the market mood deteriorates in the second half of the day, the greenback might stage a comeback and enable the USDCHF to reverse its losses. A fall back to the recent low of 0.8998 level can only be caused by a fall beneath the 0.9075 level (18 September low).

USDCHF Short term Trend: Ranging

Intraday bias in USDCHF stays on the downside as a decline from 0.9296 level is in development. The corrective recovery from the 0.8998 level might have finalized and a steeper decline may be seen to retest this low. On the upside, for the 0.9296 marks, a breach of 0.9241 minor resistance level would instead transform bias back to the upside.

Even so, an early indication of trend reversal and shifting focus back to 0.9296 main resistance level for validation might be a clear breach of 0.9200 support turned resistance. USDCHF bulls, moreover, may not be swayed until the pair reaches the resistance level of 0.9241.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.