USDCHF Price Analysis – April 30

USDCHF exchanges as at press time near 0.9735 level, reflecting a daily increase of 0.15 percent. Although the pair is turning green, they’re still stuck within the recent 0.9700-0.9800 level trading range. As a consequence, prices in a lackluster session skipped pushing significantly beyond the trading range of the prior day.

Key Levels

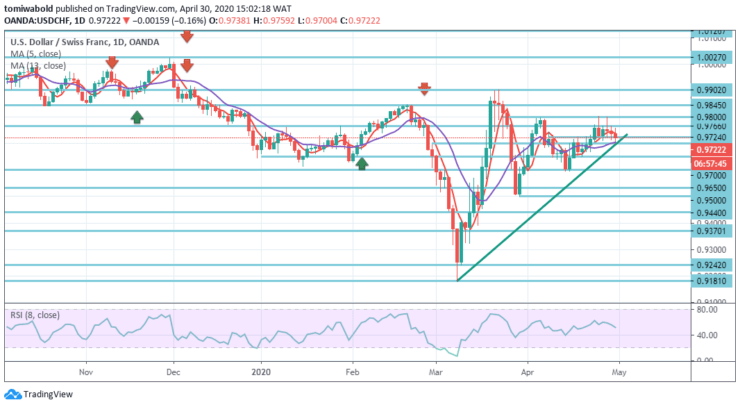

Resistance Levels: 1.0231, 1.0027, 0.9845

Support Levels: 0.9600, 0.9440, 0.9181

USDCHF Long term Trend: Ranging

The USDCHF pair drifted down through the early European session and is currently staying near the bottom of its weekly trading range, around the level of 0.9724. On Friday, the pair met with some steady supply and continued the reversal slide of the prior day from the 0.9766 level or the very critical daily moving average of 5 following the restored bears over the US dollar.

A close beyond 0.9800 level may indicate the breakdown of the range and unlock the door for a recovery of at minimum 100 pips. Conversely, passing through the lower end of the range at 0.9700 level may mean stopping the upward trend from the low of 0.9500 level on March 30 and realigning risk towards a decline to 0.9600 level (low on April 15).

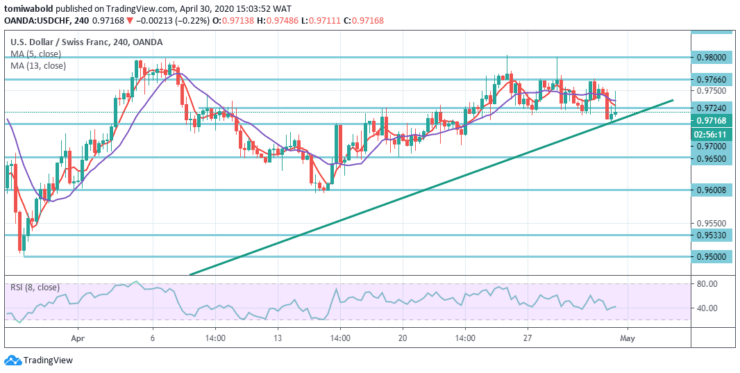

USDCHF Short term Trend: Bullish

The 4-hour chart suggests the USDCHF is consolidating around 0.9700 and 0.9800 levels since stepping beyond the rising trendline from 0.9600 low level and trading beyond. Nonetheless, the cross of moving average 5 and 13 implies the probability of a bearish shift that may bring the pair down to level 0.9700 (low April 27) and below it, level 0.9650 (low April 22) and level 0.9600 (low April 14).

On the upside, initial resistance sits at level 0.9800 and level 0.9902 (high March 24) until reaching highs at level 1.0027 in late 2019. On the downside, the top part may continue with a breach of 0.9700 minor support level. Intraday bias for 0.9600 support level next shifts to the downside.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.