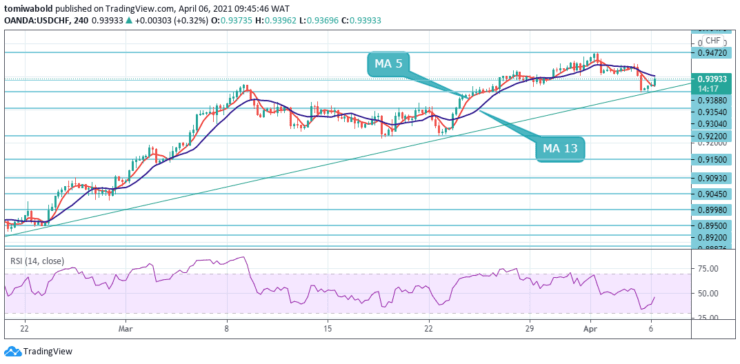

USDCHF Price Analysis – April 6

The USDCHF pair eases from the prior day’s high of 0.9438 while taking downside pressure to fresh lows, the selloff halts beyond the mid 0.9300 level during Tuesday’s European session. Renewed USD strength and mixed reports about US stimulus give investors a pause after sending US stocks to record highs.

Key Levels

Resistance Levels: 0.9901, 0.9547, 0.9472

Support Levels: 0.9354, 0.9304, 0.9220

USDCHF capitalized on its bounce at lows and rally to trade positively to intraday highs at 0.9388. Meanwhile, in a broader context, the fall from 1.0237 should have ended at 0.8756, which is an upbeat daily position. The current rally from 0.8756 should first reach the 0.9901 resistance.

There are no clear signs of withdrawal at this time. A break in this zone in the medium term will lead to the target at 1.0237 / 0342. Now this will remain the preferred option as long as the resistance at 0.9045 turns into support. Despite the rally, the overall daily trend remains in range after the initial bounce.

USDCHF’s plunge to fresh lows of 0.9354 level in the prior day and its rebound today suggests the uptrend may continue despite the minor correction. The intraday bias stays on the upside. And yet subsequent aim is 61.8% forecast of 0.9901 to 0.8998 from 0.9354 at 0.8756 levels.

Any such breach lower may pave the path to a long-term forecast level at 0.8639 level. On the upside, a breach of 0.9472 near-term resistance is required to indicate short-term bottoming. Yet still, the near-term trend stays in a range despite the anticipated recovery.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.