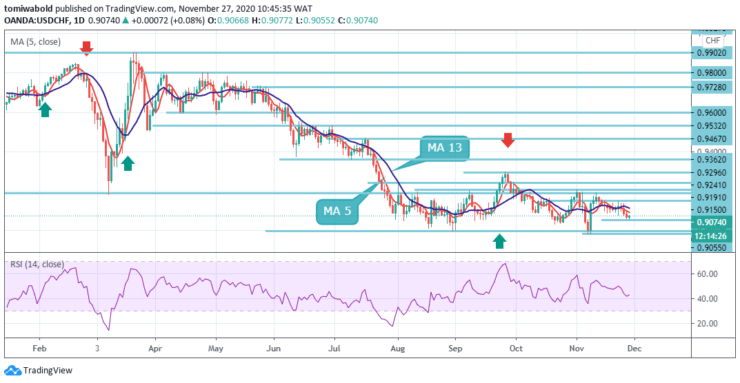

USDCHF Price Analysis – November 27

The US dollar has continued its downtrend against the Swiss franc for the 3rd day in a row, extending its downside focus beneath sub 0.9100 level on Friday. The USDCHF stays on the defensive amid risk aversion weighing the dollar against the Swiss franc.

Key Levels

Resistance Levels: 0.9296, 0.9207, 0.9150,

Support Levels: 0.9055, 0.8982, 0.8943

According to the technical analysis of the daily chart, USDCHF remains at the recent low of 0.8982 before the next low at 0.8943. Although the pair managed to find some support near the 0.9055 level and appears to have halted its recent fall from 0.9200. Therefore, any subsequent move to the 0.9200 level is likely to be seen as a selling opportunity.

In a broader context, the fall from 1.0231 is seen as the third phase of the trend from 1.0342. On resumption, the next target will be 138.2% forecast from 1.0342 to 0.9191 levels from 1.0231 at 0.8943 levels. However, a sustained breakout of the 0.9296 resistance level would be an early sign of a trend reversal and bring attention back to the key 0.9902 resistance level for testing.

USDCHF intraday bias stays moderately negative on a retest of 0.8982 low. A decisive breakout could resume a larger downtrend. On the other hand, going beyond the minor resistance level of 0.9150 may reverse the upward trend towards the resistance zone 0.9191/9207 initially.

The focus is on the 0.8982 level, the recent low. This protects the 0.8943 support and a dip at 0.8943 are required to open up space for further lows. The sustained gain could trigger near-term short-term coverage and help USDCHF return to 0.9200.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.