USDCHF Price Analysis – April 17

During the European session on Friday, USDCHF stays soft at around 0.9660 level into the American session and, in doing so, the pair stays neutral while retaining market action for sellers as well. The early optimism concerning COVID-19 virus treatment proved out to be short-lived after Gilead Sciences issued a note of caution against its antiviral drug Remdesivir.

Key Levels

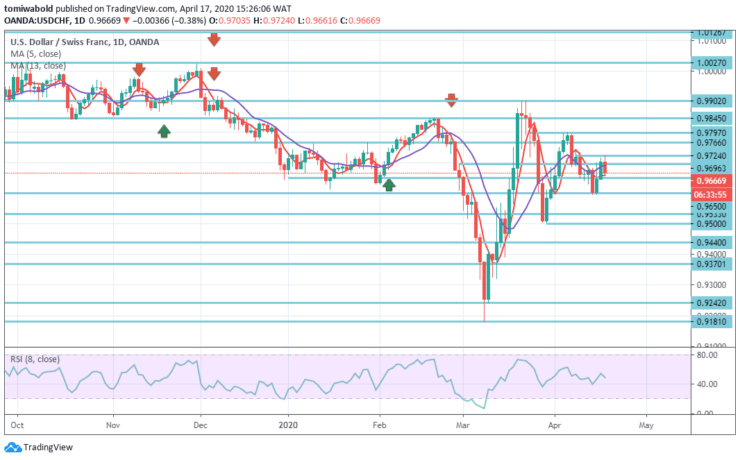

Resistance Levels: 1.0231, 0.9902, 0.9797

Support Levels: 0.9600, 0.9440, 0.9181

USDCHF Long term Trend: Ranging

In the last hour, the USDCHF pair flipped almost 45 pips from daily swing highs around the range of 0.9724. The pair quietly dropped an early dip to the region of 0.9661 and stayed neutral amid consolidations for the third consecutive session due to the emergence of some fresh US dollar buying activity after the early session.

In the wider sense, a fall from level 1.0231 is seen as the third leg of the trend from level 1.0342. Having reached 0.9242 main support (low) level, it may have ended at 0.9181 level. Retesting 1.0231 high level may be seen as a continued increase. However, medium to long term range trading is probably to remain steady between 0.9181/1.0231 levels.

USDCHF Short term Trend: Ranging

Despite RSI remaining beyond 50 signal line for 4 hours, the intraday bias in USDCHF appears slightly on the upside for resistance level of 0.9797. The break there might continue the recovery from level 0.9500 for a 0.9902 high-level retest.

At the downside, the consolidation may be prolonged under 0.9533 level from level 0.9902 with yet another decline to level 0.9500. Comparatively, the downside would include a retraction of 61.8 percent from 0.9181 to 0.9902 at 0.9440 rebound levels.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.