Sellers hold unto USDCHF market

USDCHF Price Analysis –03 October

The price may rise above $0.81 and get closer to the $0.82 hedging scenario if the buying impulse can hold above the $0.80 resistance position. If merchandisers put forth enough effort to lower the price from $0.79 to $0.77, they can still lower it to $0.76.

Key Levels:

Resistance levels: $0.80, $0.81, $0.82

Support levels: $0.79, $0.77, $0.76

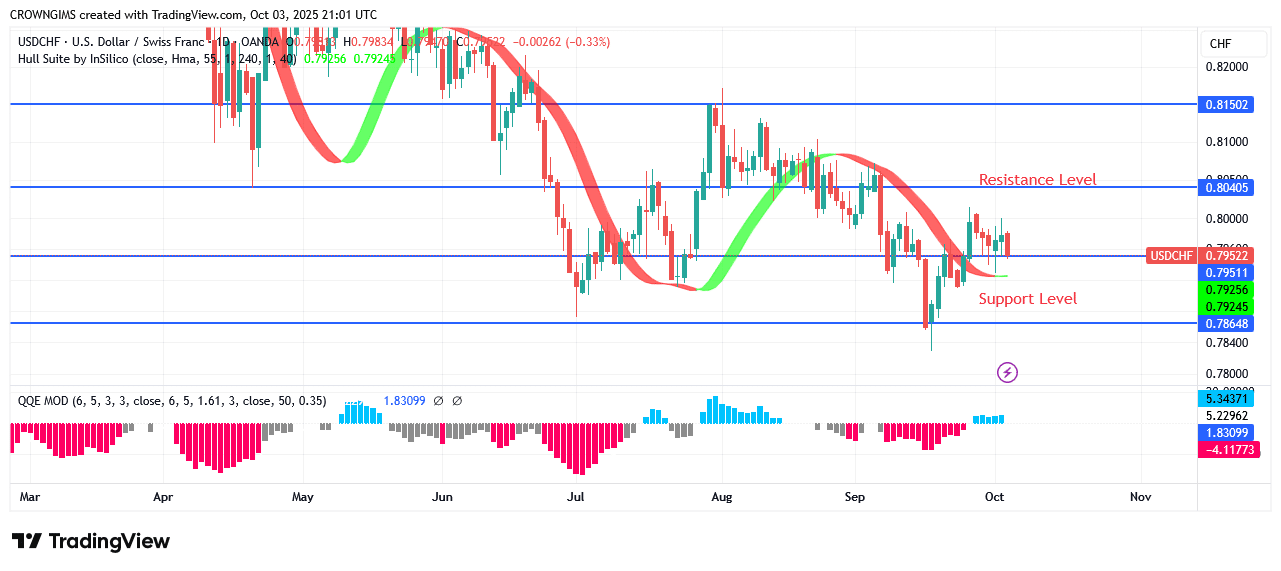

USDCHF Long-term trend: Bearish

For over a month, the USDCHF map has been on a downward trend. Since the price was established at $0.82 a few weeks ago, customers have been able to meet the massive demand for USDCHF. Merchandisers have controlled the USDCHF market since February 25. A few days ago, the value of the two currencies was $0.82. At the first recommended position, a bearish engulfing candle pattern was visible, and the price fell twice to $0.79. In addition, the price started to drop again. The bearish harami candle pattern was observed to have emerged at the first anticipated support level. The current target price is $0.79 due to its remarkable reversal.

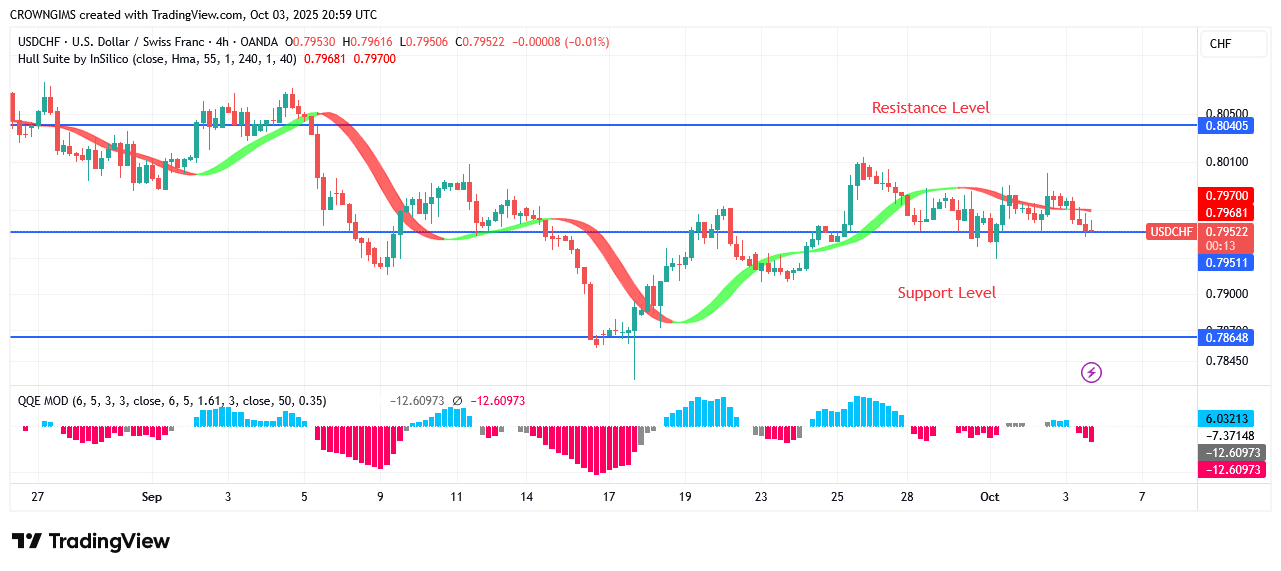

USDCHF Medium-term Trend: Bullish

The USDCHF’s medium-term prognosis is getting better. The double bottom chart pattern at the $0.79 hedging position had put the currency brace under positive pressure a few days prior. On September 17, an inner bar candle pattern emerged, and the price unsuccessfully tried to break below at $0.79. The price started to go up as one went north. The market will plummet over the previously anticipated barrier of $0.79 if bulls are successful in breaking through to the aim of $0.80. Now, the bulls are in control.

Start using a world-class auto trading solution

You can purchase Lucky Block here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.