USDCHF Price Analysis – March 2

The USDCHF pair added to the prior day’s positive traction during the early European session on Tuesday breaking higher beyond the mid 0.9100 marks. This advance comes as the dollar’s strength continues for the second day in a row with a noticeable shift in the market’s dynamics. The US ISM Manufacturing Purchasing Managers’ Index jumped to 60.8 in February, indicating rapid growth.

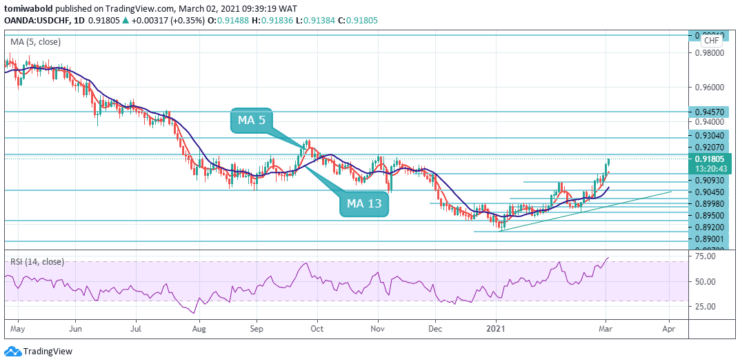

Key Levels

Resistance Levels: 0.9457, 0.9304, 0.9207

Support Levels: 0.9093, 0.8998, 0.0.8870

The USDCHF pair upside runs towards 0.9200 continues while printing fresh gains of 0.33% to 0.9178. Even so, the quote’s sustained trading above moving average 5 and 13 coupled with strong RSI at the overbought zone favor bulls. As a result, the run-up from the start of the week, at 0.9027 low level lures buyers.

Though, the Nov 2020 highs around 0.9207 level may challenge the USDCHF buyers afterward. On the contrary, a downside break of the lower horizontal level around 0.9093 level will have an upward support line from the MA 5 to contend with and is another challenge for the USDCHF sellers to pass.

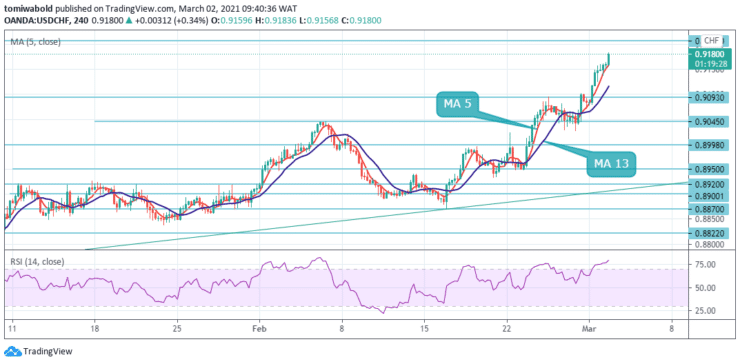

On the short-term frame of the 4-hour chart, the USDCHF pair rises to as high as 0.9180 level so far. There is no sign of topping yet. The sustained breach of 100% forecast of 0.8756 to 0.9045 levels from 0.8870 at 0.9180 will imply upside acceleration.

The following goal is the 0.9207 support turned resistance level. On the downside, beneath the 0.9093 minor support level may alter intraday bias neutral first. In such a scenario, the breach of 0.9207 resistance is required to signal near-term bottoming. Any failure to break higher may hold the pair bearish in case of rebound.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.