USDCHF Price Analysis – January 8

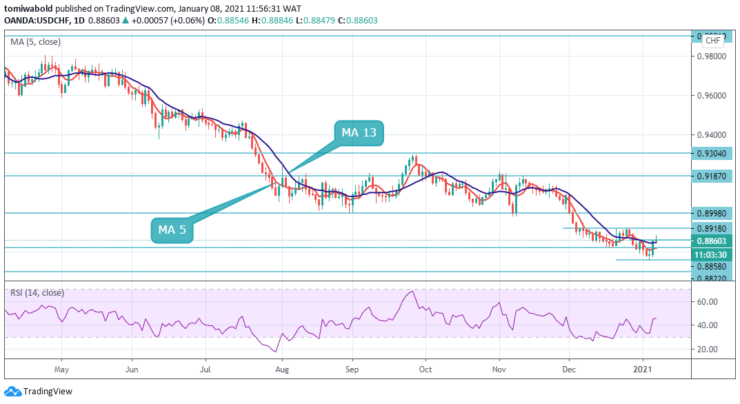

USDCHF eases from 0.8884 high, also the intraday top, to 0.8847 during early Friday. Even so, the quote prints 0.06% gains on a day while maintaining mild gains at the upside. USDCHF is trading around 0.8858 as rising US yields boost the dollar. Tension mounts toward US Nonfarm Payrolls figures for December, which are set to show a modest increase.

Key Levels

Resistance Levels: 0.9187, 0.8998, 0.8918

Support Levels: 0.8757, 0.8639, 0.8550

The USDCHF pair capitalized on its 2nd day in a row intraday uptick to trade positively to intraday highs of 0.8884 level. Meanwhile, in the larger context, a decline from the 1.0237 level is seen as the 3rd phase of the trend from the 1.0342 (high) level.

For now, there exist is no evident sign of conclusion yet. The subsequent aim will be a 138.2% forecast of 1.0342 to 0.9187 from 1.0237 at 0.8639 levels. In such a scenario, the breach of 0.9304 resistance level is still required to signal the medium to long term bottom. Despite the uptick, the overall daily trend stays bearish after the initial rebound.

USDCHF’s plunge to fresh lows of 0.8757 level suggests a downtrend may continue despite a rebound. The intraday bias stays on the downside. And yet subsequent aim is 61.8% forecast of 0.9901 to 0.8998 from 0.9304 at 0.8746 levels.

The breach may pave the path to a long term forecast level at 0.8639 level. On the upside, a breach of 0.8918 near term resistance is required to indicate short term bottoming. Yet still, the near term trend stays bearish despite the anticipated recovery.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.