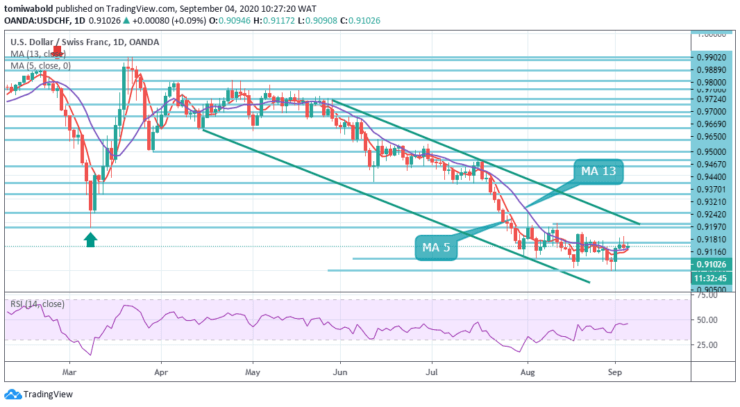

USDCHF Price Analysis – August 4

On Friday, the USDCHF exchanged in the positive territory slightly beyond the 0.9100 level and entered a consolidation phase as investors are now awaiting key US results. As of writing, the pair was up 0.19 percent on the day at 0.9112 level. After the damage from the interventionist shift of the central bank, the dollar has managed a rebound.

Key Levels

Resistance Levels: 0.9902, 0.9467, 0.9181

Support Levels: 0.9050, 0.8845, 0.8639

The US Dollar has stretched its fall against the Swiss Franc underneath 0.9100 level this past week. USDCHF, similarly, discovered strong support close to 0.9000 level, which ultimately led to a new expansion. The US dollar emerges into action on Friday after a few days of drifting, posting continual growth against the strong Swiss franc.

Continuous trading beneath the 100% forecast of 1.0342 to 0.9242 levels from 1.0231 to 0.9081 levels may open the path for a forecast of 138.2 percent at 0.8639 levels. The first sign of medium to long-term bottoming is a breach of the 0.9370 resistance level on the upside.

USDCHF continues within 0.8998/9181 thresholds and intraday bias stays first neutral. With resistance level 0.9181 remaining, more fall is still anticipated. On the downside, a breach of 0.8998 temporary low may restart a larger downward trend from 0.9902 at 0.8845 levels to a 100 percent forecast of 1.0231 to 0.9181 levels.

Even so, a continuous breach of 0.9181 level may validate short-term bottoming, and shift bias to the upside for a stronger rebound to and beyond the main horizontal resistance (now at 0.9242 level).

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.