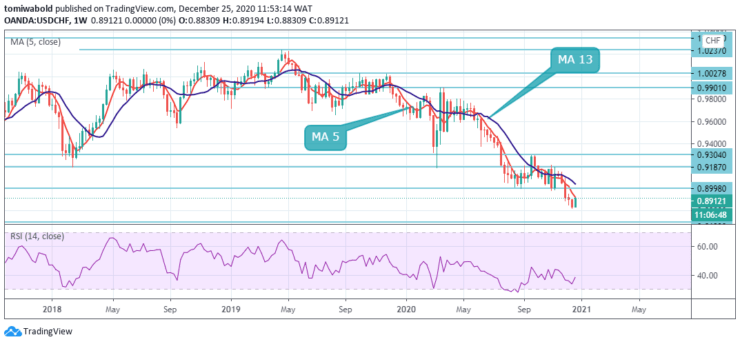

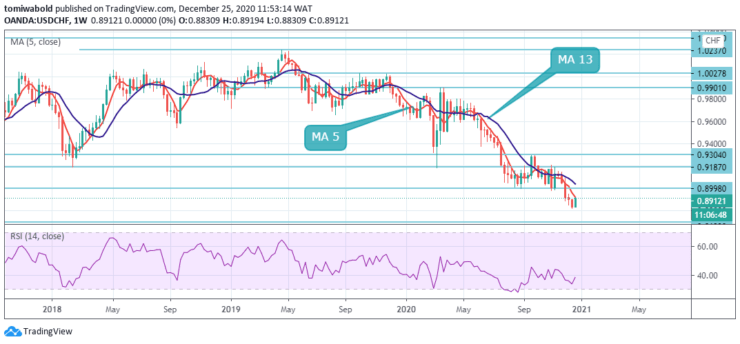

USDCHF Price Analysis – December 25

Since the beginning of 2020, the current USDCHF rate has stagnated below 1.0027. After trading near parity a year ago, the franc has strengthened since March, when the pandemic increased the willingness to take risks. At the end of the year and in 2021, the most critical event will be the ongoing coronavirus pandemic.

Key Levels

Resistance Levels: 1.0343, 0.9901, 0.9187

Support Levels: 0.8699, 0.8354, 0.7712

USDCHF is trading in the monthly range of 0.9091-0.8822 levels. At the current 0.8912 as of December 25, the USDCHF forecast represents a short-term selling opportunity as the franc is likely to rise in value in 2021.

The long-term forecast for USDCHF is the expected rebound towards the 0.9187 level. The bullish signal will strengthen as it approaches the lower support levels around 0.8699, with a target of 0.8354 forecasts for 12 months.

Last week, USDCHF fell with declining momentum. The initial bias remains until 2021. The current downtrend should target 61.8% forecast from 0.9901 to 0.8998 from 0.9304 to 0.8746 next. On the other hand, a break of the 0.8892 minor resistance would indicate a short-term bottom, with a reverse upward bias for a stronger bounce.

In a broader context, the decline from 1.0237 is seen as the third phase of the trend from 1.0342 (high). There are no clear signs of completion yet. The next target is 138.2% forecast from 1.0342 to 0.9187 from 1.0237 at 0.8699 levels. Either way, a break of 0.9304 resistance is needed to signal a mid-term day.

Conclusion

The USDCHF pair could not manage to consolidate above the 0.8900 barriers, to trade negatively and head towards resuming the main bearish trend, on its way to test 0.8820 initially, noting that breaking this level will push the price to 0.8730 as a next negative target.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.