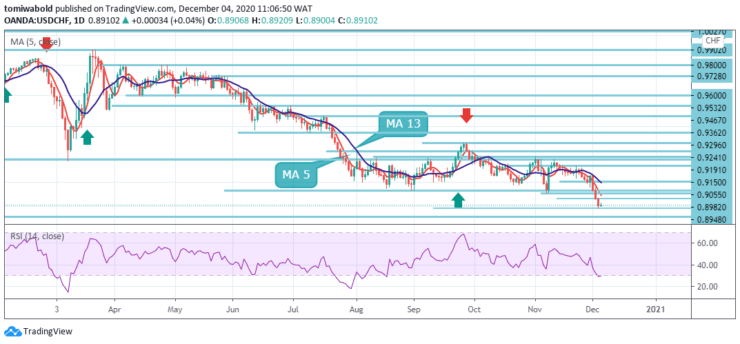

USDCHF Price Analysis -December 4

Despite heavy selling on USDCHF for 3 days in a row went beneath the 0.8900 level to fresh multi-year lows, the pair may likely rebound in subsequent sessions. The US dollar index may prolong its recent weak sentiment amid signs of progress towards additional US fiscal stimulus.

Key Levels

Resistance Levels: 0.9207, 0.9150, 0.9055

Support Levels: 0.8891, 0.8839, 0.8746

From a technical perspective, during the prior day, the USDCHF pair broke through important horizontal support near the 0.8982 level. That said, oversold conditions might help limit the fall, at least for the time being above the 0.8900 level. The pair may extend its rebound towards the vicinity of the 0.9000 level.

On the other hand, the ongoing downward trajectory may continue if the USDCHF returns beneath the 0.8900 level with eyes towards the lower horizontal support level at 0.8839. Meanwhile, any attempted recovery back towards the moving average 13 breakpoints at the 0.9055 level might be seen as a selling opportunity.

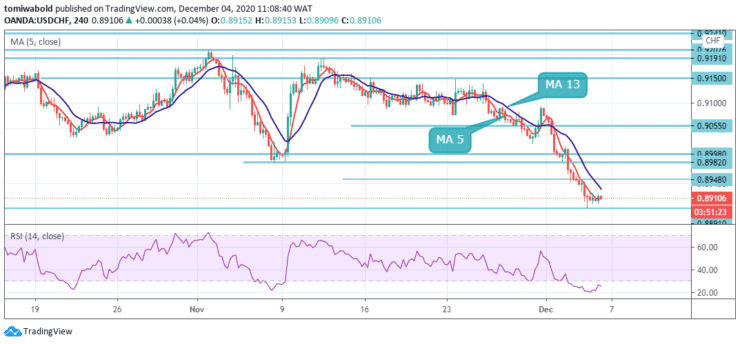

On the shorter time frame, the intraday bias in USDCHF stays mildly on the downside at this point with hopes of a rebound to the prior support turned resistance at 0.8982 level. On the flip side, the present downtrend may aim for a 61.8% forecast of 0.9902 to 0.8998 level from 0.9296 at 0.8746 level next.

However, if the rebound comes through to the upside, a break of 0.8948 minor resistance level may alter the downside bias neutral and bring a rebound immediately. Further weakness beneath the 0.8900 level may continue due to the lack of any significant levels of support in the interim.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.