USDCHF Price Analysis – November 20

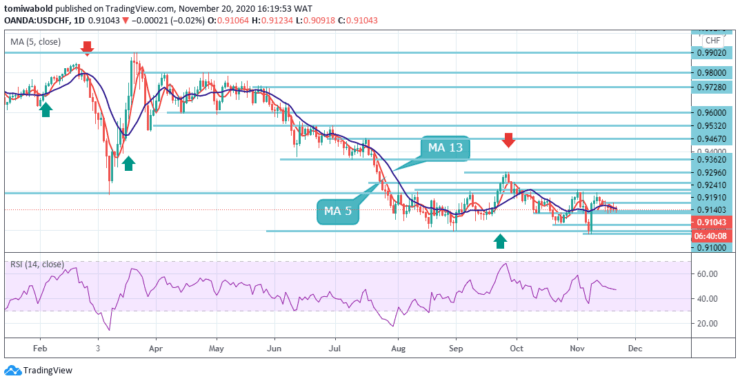

The USDCHF pair retreated under the 0.9100 level during Friday’s trading session turning south to a low of 0.9091 level. As of writing, the pair was down 0.08% daily at the 0.9104 level. All through the week, USDCHF remains on track to post small losses US Dollar Index gains mild traction.

Key Levels

Resistance Levels: 0.9362, 0.9241, 0.9140

Support Levels: 0.9090, 0.8982, 0.8639

On the daily chart, USDCHF found support at 0.9090 and if the pair attempts to breach beneath that level, it may open the path for a test of lower levels. The pair continues to consolidate in a narrow trading range between 0.9090 and 0.9140 levels, where it has been holding for 3 consecutive days.

In a broader context, the decline from 1.0231 is seen as the third phase of the trend from 1.0342 (high). However, a strong breakout of the 0.9296 resistance level would be an early sign of a trend reversal and would draw attention to the key 0.9902 resistance level for a re-test.

The intraday sentiment of USDCHF stays in a range at the moment. A further decline is moderate towards the support. On the other hand, beneath the 0.9090 level, the test at the 0.8982 low may be registered. A solid breakout from here could resume a larger downtrend.

On the other hand, a breakout of the 0.9207 resistance level should be the first sign of a bullish reversal. Otherwise, its trend may stay bearish in the event of a stronger rebound. Although there is still a long term downtrend, short and medium-term trends are consolidating.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.