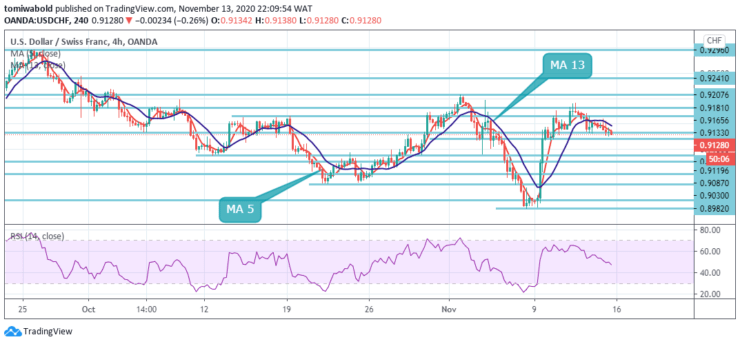

USDCHF Price Analysis – November 13

The USDCHF pair is currently trading down at 0.9131, representing a downside shift from gain to 0.9191 level during the week. The pair has pretty much erased from its weekly high. The COVID-19 vaccine news represents a challenge for the Swiss franc strength.

Key Levels

Resistance Levels: 0.9362, 0.9296, 0.9181

Support Levels: 0.9115, 0.8982, 0.8639

As seen in the daily timeframe, a close beneath the lower channel border, currently at 0.9133, may validate a breakout and expose the Nov 9 low at 0.8982. Alternatively, a close outside the Nov 2 high at 0.9207 may validate the channel lower bounce seen at 0.8982 and shift risk in support of a breakout upward to recent highs past 0.9207.

On resumption, the next aim is a 138.2% forecast from 1.0342 to 0.9181 from 1.0231 to 0.8639. However, a strong breach of the 0.9296 resistance level would be an early sign of a trend reversal and would draw attention to the key 0.9902 resistance level for a re-test.

The overall trend in the 4-hour chart of the USDCHF stays undecided and the intraday bias stays optimistic for consolidation. Further gains are still under consideration as minor support stays at 0.9115.

A decisive breach of the 0.9207 resistance level may be an early sign of a bullish reversal and a 0.9296 resistance target to test. On the other hand, beneath the minor support at 0.9115, the pair could shift back to the 0.8982 low.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.