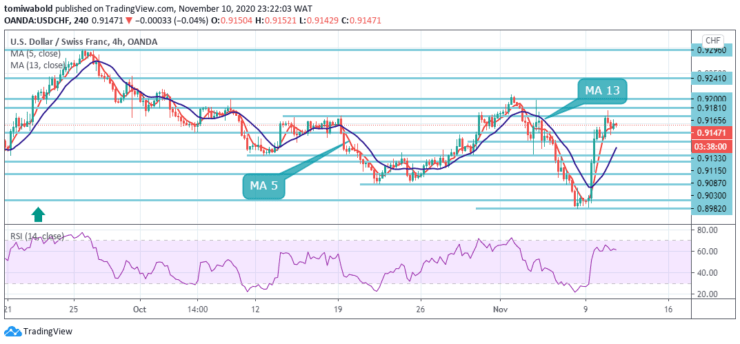

USDCHF Price Analysis – November 10

Despite USDCHF plunge to its lowest level in recent times below 0.9000, the pair posts an impressive rebound to 0.9175 level. As US Dollar Index climbs further on Tuesday, the pair continues to push higher and the risk-on market at the start of the week made it difficult for the CHF to find buyers.

Key Levels

Resistance Levels: 0.9362, 0.9296, 0.9181

Support Levels: 0.9133, 0.8982, 0.8639

For the 2nd day in a row, the US dollar stays bullish against the Swiss franc as the pair’s intra-day correction finds buyers at a level of 0.9125 from the 0.9175 session-level. In the wider sense, the decrease from level 1.0231 is seen as the third trend cycle from the level 1.0342 (high).

There is no definite indication of finishing yet, for now. The next aim will be a 138.2% forecast from 1.0342 to 0.9181 from 1.0231 at 0.8639 levels on continuance. Even so, an early indication of trend reversal and shifting attention back to the 0.9902 main resistance level for validation would be a strong breach of the 0.9296 resistance level.

For the initial 0.9200 resistance level, the intraday bias in USDCHF stays on the upside. An early indication of bullish reversal and the targeted 0.9296 resistance level for validation may well be the decisive breach here.

On the downside, for a low level of 0.8982, preference would now turn back to the downside underneath 0.9133 minor support level. After trading beyond the 0.9115 marks, the US dollar holds a near-term bid-tone after hitting levels close to the 0.9200 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.