USDCHF Price Analysis – October 23

The USDCHF has bounced up from 0.9030 lows against the Swiss Franc while selling bias continues to aim for the 0.9000 level. The greenback plunged across the board in the initial European session as hopes of a breakthrough on the US coronavirus stimulus negotiations boosted demand for risky assets.

Key Levels

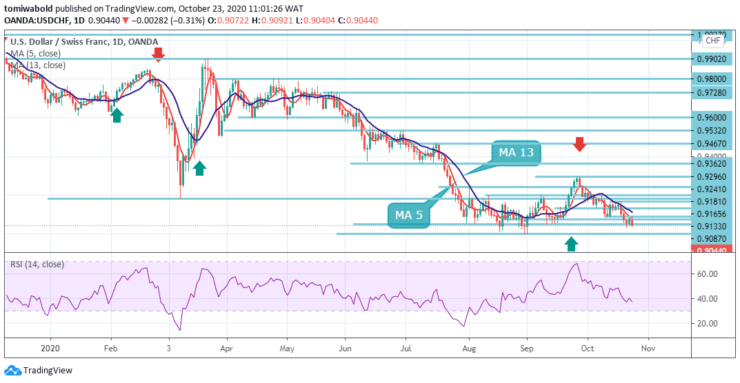

Resistance Levels: 0.9296, 0.9181, 0.9087

Support Levels: 0.8998, 0.8746, 0.8639

USDCHF is in recovery from the previous session when it reached support at 0.9030. To reverse the bearish sentiment and begin to examine if the bulls have gained the upper hand, buyers may try to decisively break the 0.9133 level. Another break above 0.9165 could have more bullish implications, possibly paving the way towards 0.9200.

In a broader context, the decline from 1.0231 is seen as the third phase of the pattern from 1.0342 (high). There are no clear signs of completion yet. On resumption, the next target is 138.2% forecast from 1.0342 to 0.9181 from 1.0231 at 0.8746 levels. However, a strong breakout of the 0.9296 resistance level would be an early sign of a trend reversal and would draw attention to the key 0.9902 resistance level for confirmation.

The intraday sentiment for USDCHF remains neutral. Further decline is expected while the resistance level of 0.9165 is held. Below 0.9030, the 0.8998 low will first be reached. The break would resume the larger downtrend with a 61.8% forecast from 0.9902 to 0.8998 from 0.9296 at 0.8746 levels. However, a break of the 0.9165 resistance level would delay the bearish case.

Here the intraday bias will be pulled back upwards to continue consolidation from the 0.8998 level with a new phase of growth. Looking at the short-term oscillators, we see that the RSI is shifting below 40 zones and now appears to be approaching 30, while moving average 5, although negative, is above the moving average of 13 lines.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.