USDCHF Price Analysis – October 16

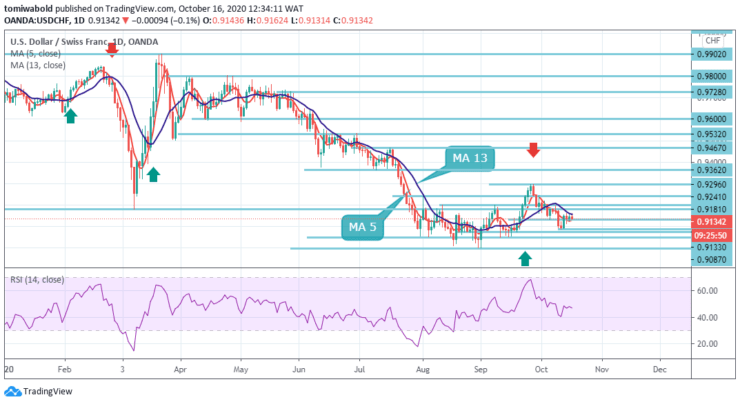

USDCHF hovered around its weekly highs while maintaining an upward trend above the 0.9100 average, although there were no strong subsequent purchases. During the European session on Friday, the pair hovers around the daily high of 0.9162, which is currently down 0.10% to hit 0.9134.

Key Levels

Resistance Levels: 0.9600, 0.9467, 0.9296

Support Levels: 0.9075, 0.8998, 0.8639

Technically speaking, as seen in the daily chart, recent range-related price action requires some caution before making any aggressive directional bets. However, the fact that USDCHF found recognition above the 5 MA and 0.9100 level favors bull traders and supports further growth prospects.

In a broader context, the decline from 1.0231 is seen as the third phase of the pattern from 1.0342 (high). There are no clear signs of completion yet. On resumption, the next target is 138.2% forecast from 1.0342 to 0.9181 from 1.0231 at 0.8639 levels. However, a strong break of the 0.9370 support level, which turned resistance, would be an early sign of a trend reversal and would look to the key 0.9902 resistance for confirmation.

The intraday bias of USDCHF remains neutral as consolidation from the temporary low of 0.9087 is still ongoing. With the resistance level at 0.9200 unchanged, further decline is still possible. On the other hand, a breakout of 0.9087 would first retest the 0.8998 low.

On the other hand, a breakout of the 0.9200 level will extend the corrective pattern from the 0.8998 level with a new rally to the 0.9296 resistance level and above. As a result, the bears are waiting for a clear break below 0.9133 for new entries.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.