USDCHF Price Analysis – October 2

USDCHF takes the bids beyond the 0.9200 level, up 0.21% on a day, ahead into Friday’s American session. A mixed payroll report and rising uncertainty may favor the greenback while a COVID-19 test may elevate the risk sentiment more broadly.

Key Levels

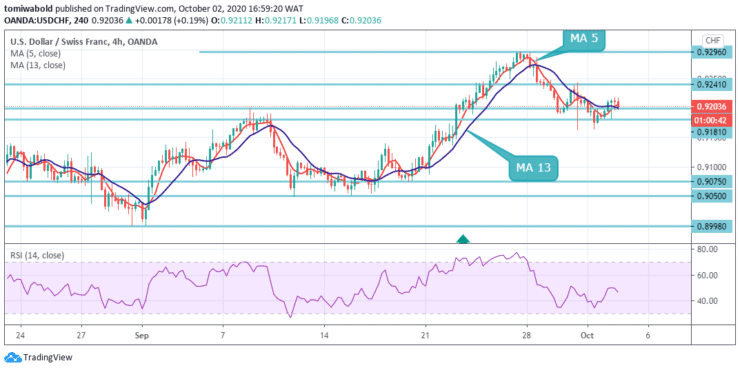

Resistance Levels: 0.9467, 0.9362, 0.9241

Support Levels: 0.9181, 0.9075, 0.8998

USDCHF stays at level 0.9185 between the moving average of 5 and 13 and was last seen trading at level 0.9198 after growing beyond level 0.9200. The market has continued to generate higher highs and higher lows, and the next support could be the moving average 13 if the price starts to plummet.

The decrease from the level of 1.0231 is viewed as the third phase of the trend from 1.0342 (high) level in the larger sense. There is still no definite mark of finalization. On continuation, the next aim may be an estimated 138.2 percent of 1.0342 to 0.9181 from 1.0231 at level 0.8639 levels. Even so, an early indication of trend reversal and shifting the emphasis back to 0.9902 main resistance for validation might be a major breach of 0.9370 support turned resistance level.

With 4 hours of RSI crossing underneath the midlines, the intraday bias in USDCHF is considered neutral. As well as the 0.9241 slight resistance level intact, another plunge is in order. The corrective pullback from the level of 0.8998 might have already ended with three stages up to the level of 0.9296.

A test at a low level of 0.8998 may hit the 0.9181 level. On the upside, the rebound may restart the breach of the 0.9241 level to 0.9296 level, to 38.2 percent retracement from 0.9902 level to 0.8998 at 0.9362 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.