USDCHF Price Analysis – September 25

The USDCHF pair gained traction for the 5th day in a row and shot to 2-month highs past the 0.9200 level during the early European session. The improved dollar index is presently boosting the USDCHF bull case with a pullback most likely in the nearest future.

Key levels

Resistance Levels: 0.9902, 0.9550, 0.9321

Support Levels: 0.9200, 0.9116, 0.8998

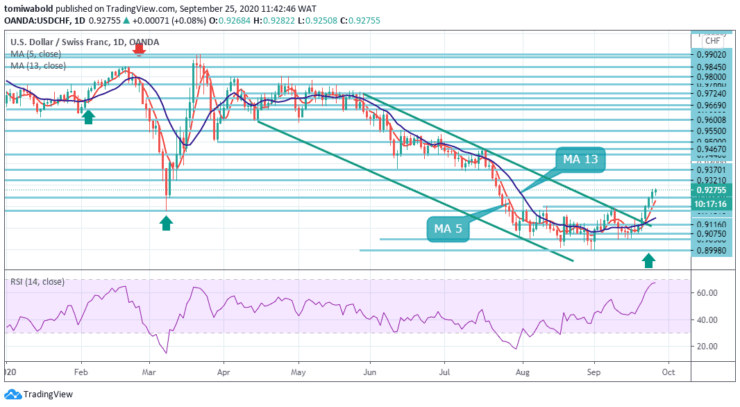

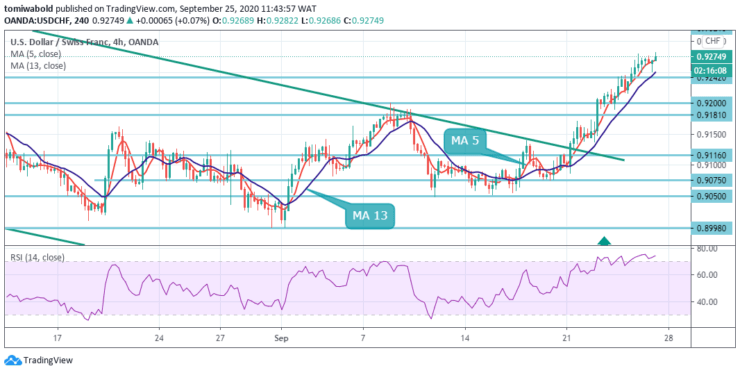

On the daily time frame, the momentum reaffirmed the prior day bullish break through the horizontal resistance turned support level at 0.9242 by pushing higher to 0.9282 level for the first time in six months. A subsequent strength towards the 0.9300 strong marks is expected to prompt some technical buying.

Dips should remain contained by 0.9200 level near the horizontal support barrier. Only a slide below 0.9181 level will trigger a slide back to the 0.8998 recent low level. Nevertheless, a strong break of 0.9376 support turned resistance level will be an early sign of trend reversal and turn the focus back to the 0.9902 key resistance level.

Intraday bias in USDCHF stays on the upside at this point. The rebound from 0.8998 level should target 38.2% retracement of 0.9902 to 0.8998 at 0.9321 levels. Meanwhile a sustained break there will open the path to 61.8% retracement at 0.9550 levels.

On the downside, a break of 0.9181 minor support level will turn intraday bias neutral and bring some consolidations first. However, the bullish scenario may no longer be valid if the price breaks the downside border and fixes below the 0.9200 level. In this case, the pair may continue falling towards 0.9116 levels.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.