USDCHF Price Analysis – July 31

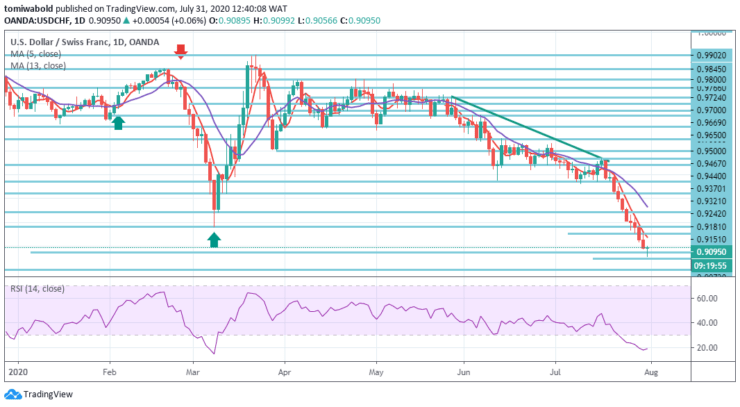

During the early European session, the USDCHF pair witnessed some selling and plummeted towards psychologically low at 0.90- the lowest level since May 2015. Furthermore, the safe-haven CHF earned from a selloff in US stock markets.

Key Levels

Resistance Levels: 0.9902, 0.9467, 0.9181

Support Levels: 0.9047, 0.9000, 0.8969

USDCHF is trying to broaden its push beneath the key lows of 2018 and March 2020 to 0.9000 level, further supporting the view that presently we may see a weekly closing underneath this important inflection level.

A close beneath the May 2015 low at 0.9072 level might just see support at 0.9047 level, ahead of the 0.9000 level psychological barrier, where we may see an initial attempt to hold. In the positive, the first sign of medium-term bottoming would be a breach of 0.9362 resistance level.

The decline of USDCHF is so far worsening to a level of 0.9056. The forecast level of 0.9081 over the medium term is already reached but there is no indication of bottoming yet. On the downside, the intraday bias continues.

The next near-term goal will be a forecast of 161.8 percent from 0.9467 to 0.9370 levels at 0.8969 levels. On the upside, a lower resistance level beyond 0.9151 may transform neutral the intraday bias and first offer stabilization, before another downside is triggered.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.