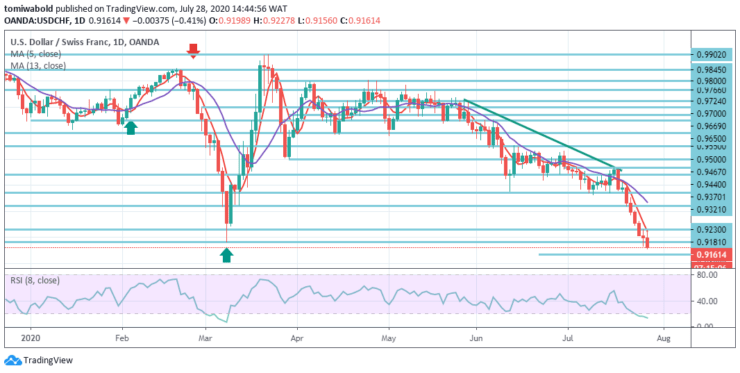

USDCHF Price Analysis – July 28

The USDCHF pair ended Monday’s seventh consecutive day in the negative territory and kept pushing down on Tuesday. USDCHF plunges beneath critical levels as dominant Swiss drags down pair. The pair was down 0.41 percent daily at 0.9156 level as of writing. Combined with the risk-averse climate, the broad-based USD Weakness weighed heavily on USDCHF.

Key Levels

Resistance Levels: 0.9902, 0.9669, 0.9370

Support Levels: 0.9134, 0.9000, 0.8969

Since July 16, the US Dollar has fallen against the Swiss Franc by 284 pips or 3.00 percent. During this time, the moving average of 5 pressured the currency pair down. Considering that the moving average of 5 and 13 is holding steady beyond the price level, bearish investors may keep hitting down the exchange rate during trading sessions this week.

The weekly support level at 0.9134 level, however, may in the near term offer support for the currency exchange rate. Within the wider context, the fall from level 1.0231 is seen as the third phase of the trend from level 1.0342. Emerging activity indicates these trends are already expanding.

To use existing downside traction, the decline of USDCHF continues after a brief rebound and the intraday bias is back on the downside. The present fall are been set beneath 0.9081 level for the next prediction phase.

On the contrary, a breach of 0.9230 minor level of resistance might well neutralize intraday bias. Yet potential trend will stay bearish as long as, in the situation of recovery, 0.9370 support level turned resistance level remains.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.