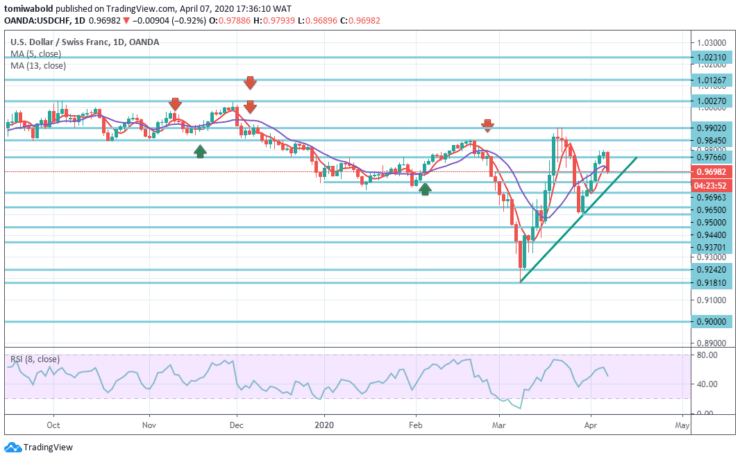

USDCHF Price Analysis – April 7

The USDCHF pair kept losing support in the American session through the early European, though recently registering daily lows underneath the 0.9700 level. Indications that the coronavirus global epidemic may hit its height in Europe and the United States have caused some lengthy-winding volatile trading in the US dollar.

Key Levels

Resistance Levels: 1.0231, 10027, 0.9902

Support Levels: 0.9650, 0.9440, 0.9181

USDCHF Long term Trend: Ranging

In the wider sense, a fall from level 1.0231 is viewed as the third leg of the trend from the level of 1.0342 (high). Having reached 0.9242 main support (low) level, it might have ended at 0.9181 level.

The exchange rate may keep rising in an ascending trendline pattern, all arguments aside. Within the sessions of this week, bulls may push the price toward the 1.0126 level.

USDCHF Short term Trend: Ranging

USDCHF intraday bias maintains moderate with an emphasis on 0.9650 limited level of support. A break may signify the completion of the rebound from the level of 0.9500, as an adjustment from the level of 0.9902 then would initiate the third leg.

The intraday bias may be adjusted back to the downside first at 0.9440 level for a 61.8 percent retracement from 0.9181 to 0.9902 level. On the upside, however, the 0.9902 high level may approach past the 0.9766 level.

Instrument: USDCHF

Order: Sell

Entry price: 0.9766

Stop: 0.9845

Target: 0.9650

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.