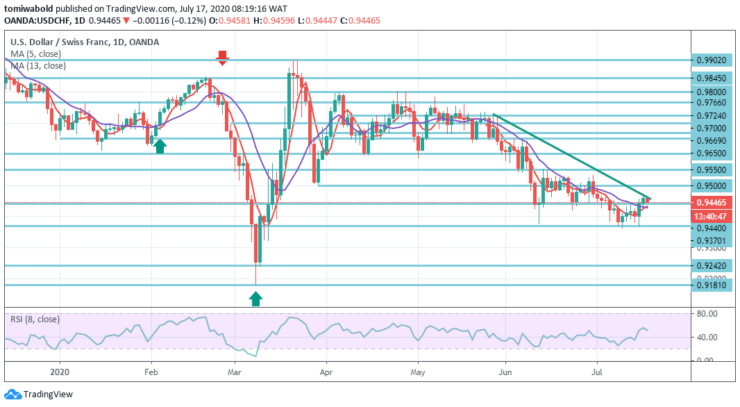

USDCHF Price Analysis – July 17

In the previous session, the pair established an upside candle that confirmed a price reversal higher from the March high downside of 0.9902 level. Simply put, one might anticipate buyers to attempt the psychological level of 0.95, which might affirm the overall bias once breached.

Key Levels

Resistance Levels: 1.0027, 0.9724, 0.9550

Support Levels: 0.9370, 0.9242, 0.9181

On the daily chart, USDCHF is seen bouncing off June’s level of 0.9370 towards the high levels of 0.9500/50 around mid and late June. Those may need to be resolved to relieve the recent downside pressure and to make possible a return to the horizontal line of resistance at 0.9600 level.

Even more on the upside, the 0.9901 level breach may accelerate the recovery from level 0.9181 to resistance level 1.0027. And besides, medium- to long-term range trading is inclined to maintain for some longer between levels 0.9181/1.0231.

The bias still favors moderately the view that a short-term bottom in USDCHF was established at 0.9370 level. Yet another increase to level 0.9550 may be seen. The continuous breach there may validate this scenario and bring out the bullish potential for a higher increase in the near term.

However, the 0.9370 level breach may restart the decrease from 0.9902 to 100% projection from 0.9902 to 0.9500, from 0.9724 to 0.9242 levels. The low of June 11 sits beneath the 0.9370 level support area, and further down the low of March at 0.9181 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.