USDCHF Price Analysis – August 4

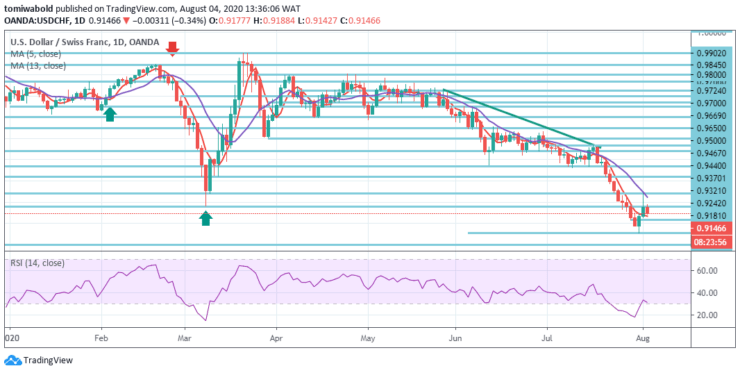

Last week, USDCHF struggled to finish underneath the low level of 0.9056 and the demand is strengthening in the near term. The 0.9467 marks are anticipated to cap the upside rally with the pair trading at around 0.9156 level and beyond today.

Key Levels

Resistance Levels: 0.9902, 0.9467, 0.9181

Support Levels: 0.9047, 0.9000, 0.8969

During the European session on Tuesday, USDCHF nears the top of the immediate trading range while taking rounds underneath 0.9180 level. By doing so, the quote falters in its recovery, going from the low level beneath level 0.9156. The down-moves also draw pointers from 70 zones of the RSI parameters.

Within the broader sense, a decrease from level 1.0231 is perceived as the third phase of the pattern from level 1.0342 (low). A recent trend implies such patterns are still deepening. Feasible trade beneath the 100% forecast of 1.0342 to 0.9242 levels from 1.0231 to 0.9081 levels may open the path for a forecast of 138.2 percent at 0.8639 levels.

The short-term rebound from 0.9056 level is still in support of continuing to the level of 0.9370 cluster resistance (38.2% retraction from 0.9902 to 0.9056 at 0.9370 levels). Initial resistance is the short term downtrend of 0.9370 ahead of the harder resistance level of 0.9321. And yet the upside is to bring a further fall to be restricted there.

On the downside, a weak support level beneath 0.9116 level would carry a retest of 0.9056 level. Continuous breach of 0.9370 level, after all, may bring stronger rally at 0.9550 level to 61.8 percent retracement. Whereas in a situation bulls deteriorate to bring the upside, which is less probable, 0.9116 and 0.9100 levels may provide initial support for the pair.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.