USDCHF Price Analysis – April 20

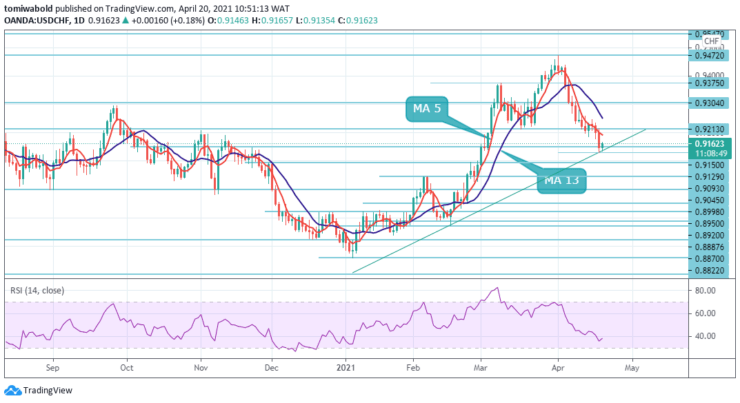

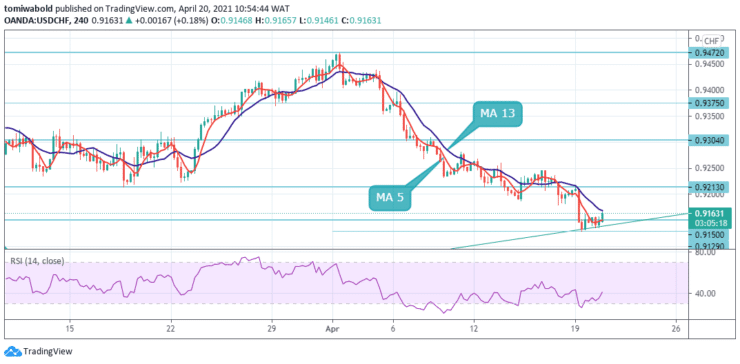

During the first half of the European session on Wednesday, the USDCHF pair continued its downward trend, falling to seven-week lows near 0.9135 level. In the wake of USD weakness, the pair appears to be having trouble staging a meaningful rebound. As of this writing, the pair is trading around the 0.9160 level, unchanged on the day.

Key Levels

Resistance Levels: 0.9472, 0.9375, 0.9213

Support Levels: 0.9129, 0.8998, 0.8757

USDCHF is currently trading below its 5 and 13 moving average, suggesting a downward trend. Markets may suggest that price would test a new low at 0.9093 if the ascending trendline is breached. A turnaround from the downtrend channel’s upper boundary would be another warning in favor of the downtrend’s continuation.

At the present moment, the failure of the 61.8 percent pullback of 0.9901 to 0.8757 at 0.9472 suggests that the bounce from 0.8757 was most likely just a corrective step. That is, the larger downturn from 1.0237 could still be ongoing. Traders’ eyes will be on the downside momentum of the fall from 0.9472 to see if the 0.8757 low can be broken.

The USDCHF is still stuck in a range that started at a temporary high of 0.9472. The intraday sentiment is initially bearish. If there is another rebound, upside capacity should be restricted by the 0.9213 former support level, which has now turned into a resistance level, signaling the start of a new decline.

A breakout of 0.9129 low, on the other hand, could result in a 61.8 percent projection from 0.9902 to 0.8998 from 0.9304 at 0.8757 next. The pair struggled to profit from the previous session’s rebound attempts, and a strong break below 0.9150 does not prevent the 0.9100 level from being tested.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.