USDCHF Price Analysis – June 26

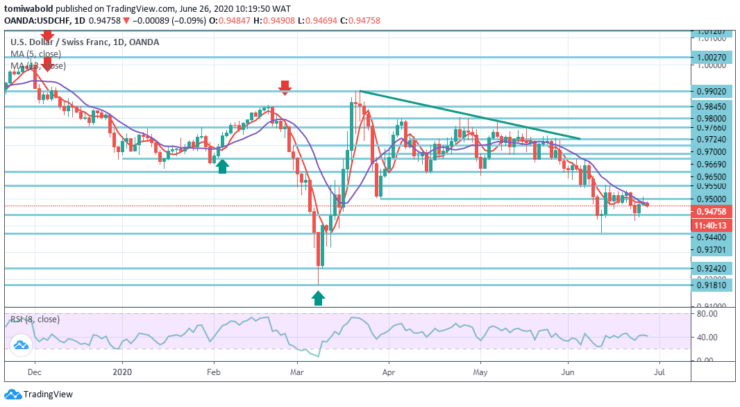

USDCHF loosens to 0.9472 level, while still down 0.11 percent on a day, the pair may re-attempt the 0.9550 level after the pair’s initial downside pressure in the prior session was confined.

Key Levels

Resistance Levels: 1.0027, 0.9766, 0.9550

Support Levels: 0.9440, 0.9370, 0.9181

The pair registered a bearish pattern after initiating a retraction from the recent low reached at Wednesday’s horizontal support level of 0.9440. The sellers thus seek a follow – up to the initial support line around 0.9440 level, with 0.9500 serving as initial resistance.

Even so, any more downside past-0.9440 level may test 0.9400 round-number before propelling the bears to the close 0.9370 (low) level. Similarly, a precise breach beyond Thursday’s high past 0.9508 level may attempt for subsequent resistance levels of 0.9550 and 0.9600.

USDCHF has recovered a bit and weakens the short-term downside trend, limiting initial downside pressure and enabling for a potential re-test of the initial high level of 0.9550. It may have to be cleared up if another downside pressure is to be fully confined and the short-term uptrend at 0.9669 level is enabling towards rebound.

Though confined by the downtrend, a negative outlook may continue and the downside goal may stay at the level of 0.9370 (low) and the retraction of 78.6 percent at 0.9242 level, which is the last support for low of March at 0.9182 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.