USDCHF Price Analysis – April 21

The USDCHF pair tug of war between lackluster gains/slight losses and stayed limited through the early European session in a small trading range, past the 0.9700 mark. In the absence of early important releases of macroeconomic data and fundamental events on the 2nd day of the week, risk sentiment becomes the dominant catalyst of currency markets.

Key Levels

Resistance Levels: 1.0231, 0.9902, 0.9797

Support Levels: 0.9600, 0.9440, 0.9181

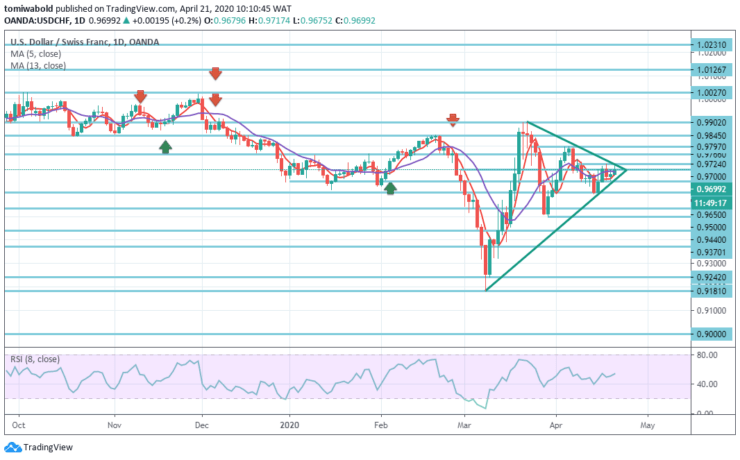

USDCHF Long term Trend: Ranging

As shown in the daily chart, reflecting at the wider context, over the past one month or so, the pair has fluctuated between two converging trend-lines, creating a symmetrical triangle on the daily chart.

In the broader context, the 0.9902 level break may increase the 0.9181-level recovery process into 1.0027-level resistance. However, medium- to long-term activity in ranges is expected to continue for a little longer between 0.9181/1.0231 levels.

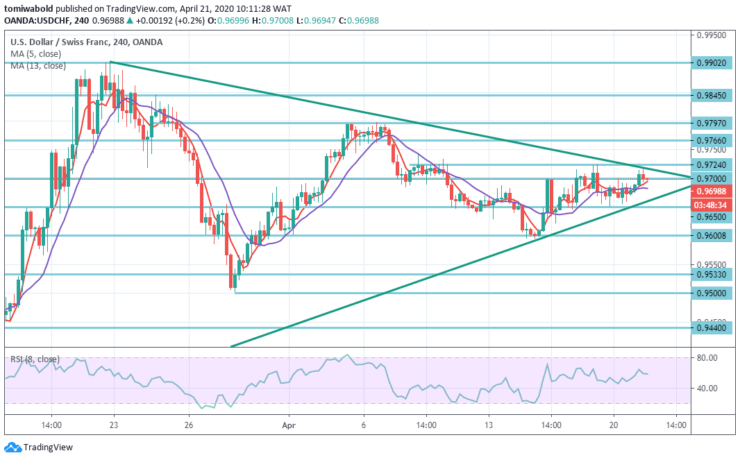

USDCHF Short term Trend: Ranging

USDCHF intraday bias stays optimistic as consolidation intensifies. A break of 0.9600 level on the downside may carry a further drop. Yet downside may be limited by retracing 61.8 percent from 0.9181 to 0.9902 to recover at 0.9440 levels. On the upside, 0.9797 level breach may bring 0.9902 high-level retests.

Therefore, waiting for a convincing breakout in either position would be appropriate before validating the pair’s near-term trajectory despite ongoing confusion about the coronavirus disease outbreak.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.