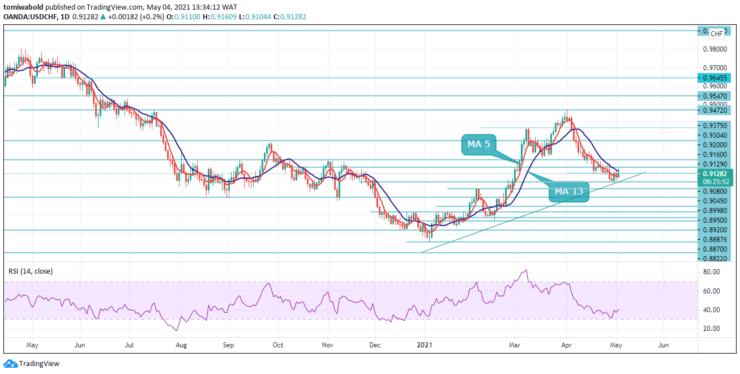

USDCHF Price Analysis – May 4

During the European session, the USDCHF brings the buyers’ interest to the test, with the possibility of a recovery from the downside pressure to crack the sellers’ grasp. As technicals reveal a dominant selling side, buyers smashed through the barrier at 0.9150. The dollar is being boosted by expectations of stronger economic growth in the United States.

Key Levels

Resistance Levels: 0.9472, 0.9300, 0.9160

Support Levels: 0.9080, 0.9045, 0.8998

The US dollar remains bullish against the Swiss franc at the beginning of the week, as the pair’s intra-day correction finds buyers at 0.9110 level, up from 0.9104. In a broader sense, the drop from 0.9472 medium-term high is considered the 2nd pattern period since the plunge from a recent high of 0.9901.

For the time being, there is no sign that the range will be completed. In continuation, the next goal will be a 138.2 percent projection from 0.9901 to 0.8757 from 0.9472 at 0.9080 levels. A successful break of the 0.9200 resistance level, however, will be an early sign of trend reversal and a change of focus back to the 0.9300 key resistance level for confirmation.

The short-term risk in the USDCHF market appears to be seeking to retain its downside in the 4-hour time frame, in addition, trend signals remain mixed for now, indicating that any price strength may be transitory.

Overall, the outlook for USDCHF remains unchanged, and the intraday bias is initially neutral. The trading range starting at 0.9472 is widening. In the event of a steeper fall, the 38.2 percent retracement of 0.9080 to 0.9160 levels at 0.9127 could absorb the downside step and usher in a stronger recovery.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.