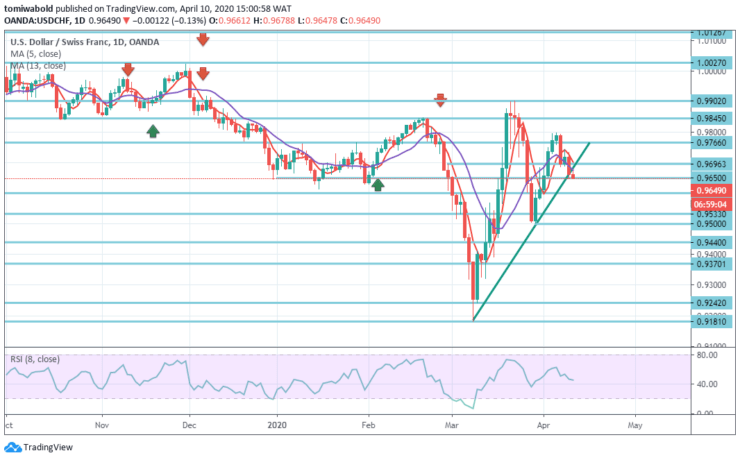

USDCHF Price Analysis – April 10

After breaking beneath its ascending trendline, USDCHF found some footing around the 0.9650 handles expanding its price action to the crucial level. Although the inactive session of Good Friday restricts the movements of the FX pair, it stays on the back foot around the level at 0.9650.

Key Levels

Resistance Levels: 1.0027, 0.9902, 0.9766

Support Levels: 0.9600, 0.9440, 0.9181

USDCHF Long term Trend: Ranging

At the moment there is no significant shift in the trend of USDCHF. Long to medium term bias stands firm with an emphasis on the lower support level of 0.9600. Break there indicates recovery from level 0.9500 in total. Whereas the correction from the level at 0.9902 would then have begun the third leg.

Long-term and medium-term bias will be corrected to the downside again at 0.9440 levels for a 61.8 percent retraction of 0.9181 to 0.9902 levels. In the upside, instead, the high may approach beyond the 0.9766 level.

USDCHF Short term Trend: Ranging

USDCHF’s 0.9696-minor support level break and the upward trendline indicate a reversal from 0.9500 level. The adjustment from the level of 0.9902 would then have begun another round of consolidation in the short term.

The intraday bias is now on the downside again at 0.9440 level for a 61.8% retracement from 0.9181 to 0.9902 level. On the upside, the 0.9766 level above may instead approach the 0.9901 high level.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.