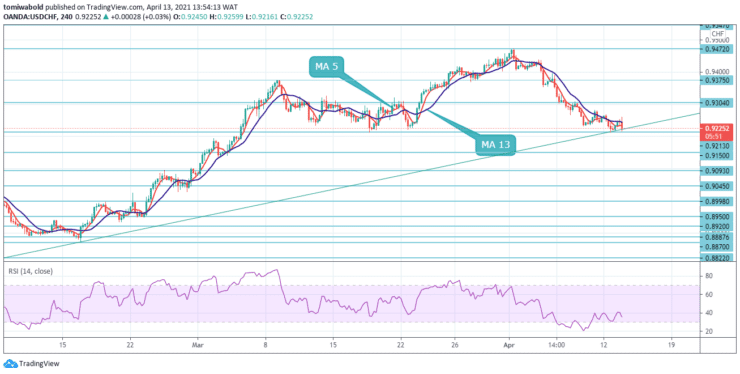

USDCHF Price Analysis – April 13

After plunging for 5 consecutive days, the USDCHF pair bounces off lows around 0.9200 early on Tuesday’s European/American session. The pair’s rebound is up around 0.9259 intraday high and at the time of this post was hovering around the 0.9213 level. The US dollar is in a cautious mode as traders react to inflation data which would dictate the next movement.

Key Levels

Resistance Levels: 0.9472, 0.9375, 0.9300

Support Levels: 0.9213, 0.9150, 0.9093

The US dollar’s attempt to strengthen against the Swiss franc has gained traction at the recent low of 0.9213 level, with the pair gaining almost 31 pips after finding support around the 0.9200 prior days low level. The USDCHF pair needs to break the 0.9300 resistance level to balance the overall forecast. Medium to long term analysis continues to suggest that USDCHF downside bias is over around the ascending trendline support and its rebound will continue higher.

In a broader context, the decline from 1.0231 is seen as the concluding phase of the trend from 1.0342 (high). There are no clear signs of confinement. The next target is 138.2% forecast from 1.0342 to 0.9187 from 1.0231 at 0.9300. In such a scenario, a break of the 0.9304 resistance level is required to signal a mid-term session.

With slight resistance at 0.9300 intact, the correction from 0.9472 could continue lower. However, the 38.2 percent retracement of 0.8756 to 0.9472 at 0.9213 should limit the downside and allow for recovery. On the upside, a break above 0.9300 would shift the bias to the upside, allowing for a return to the 0.9472 high.

However, a sustained break of 0.9213 would result in a more significant drop to the 61.8 percent retracement level of 0.9045. If the pair manages to break resistance levels and surge higher, it would immediately face the resistance of the horizontal line at 0.9375 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.