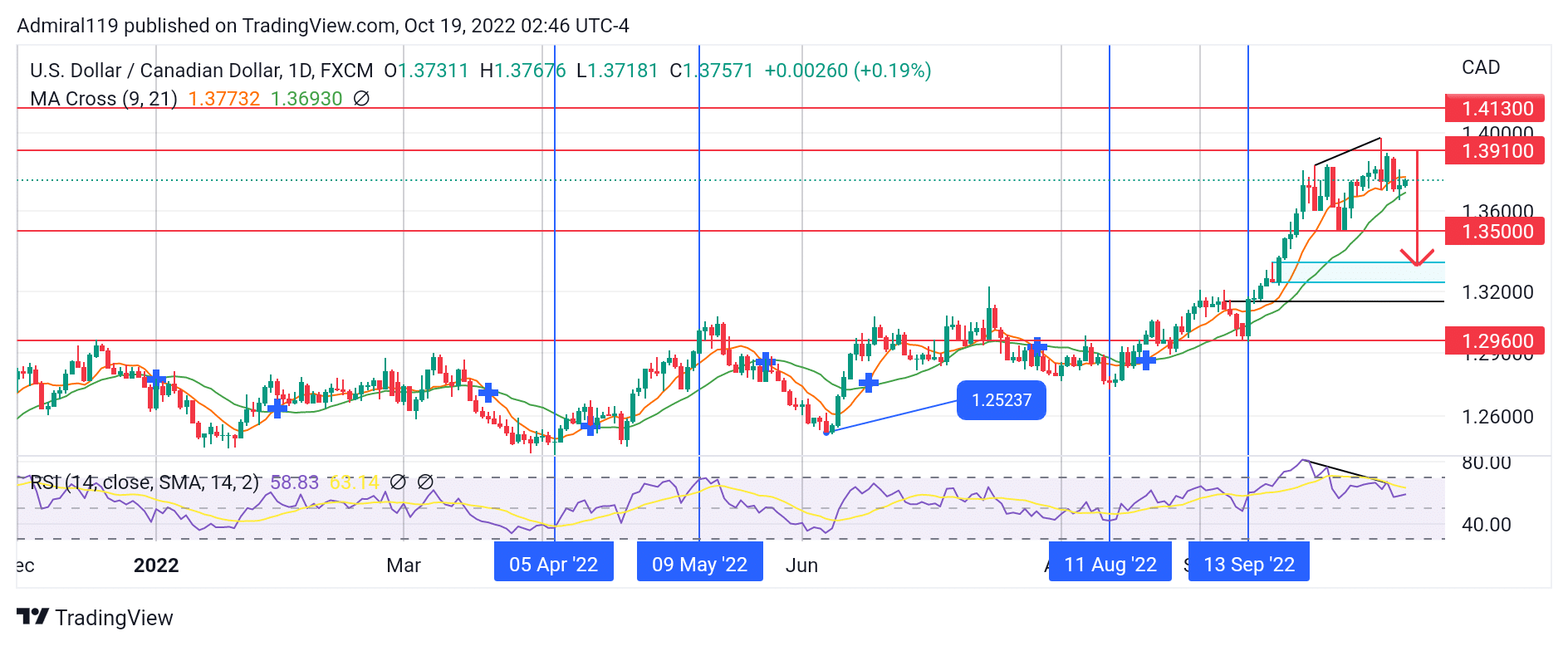

USDCAD Analysis – October 19

USDCAD sellers aim lower following a bearish divergence’s indication at the 1.3910 supply zone. At the first bounce off the demand zone at 1.2960, prices began to expand upward. Towards the end of last year, USDCAD bounced off this level as it got crashed to the downside by the USDCAD sellers.

USDCAD Significant Zones

Demand Zones: 1.3500, 1.2960

Supply Zones: 1.3910, 1.4130

On August 11, 2022, after a relatively long period of gyration around the range’s resistance, the price surged inward to capture sell-side liquidity. As the price broke out of the trading range to the upside, this liquidity grab rendered the resistance completely invalid. A quick bounce off the invalidated resistance brought about the current market environment on the daily chart. Until the emergence of the bearish divergence, the USDCAD sellers were completely squeezed out of the market in the course of the expansion to the upside.

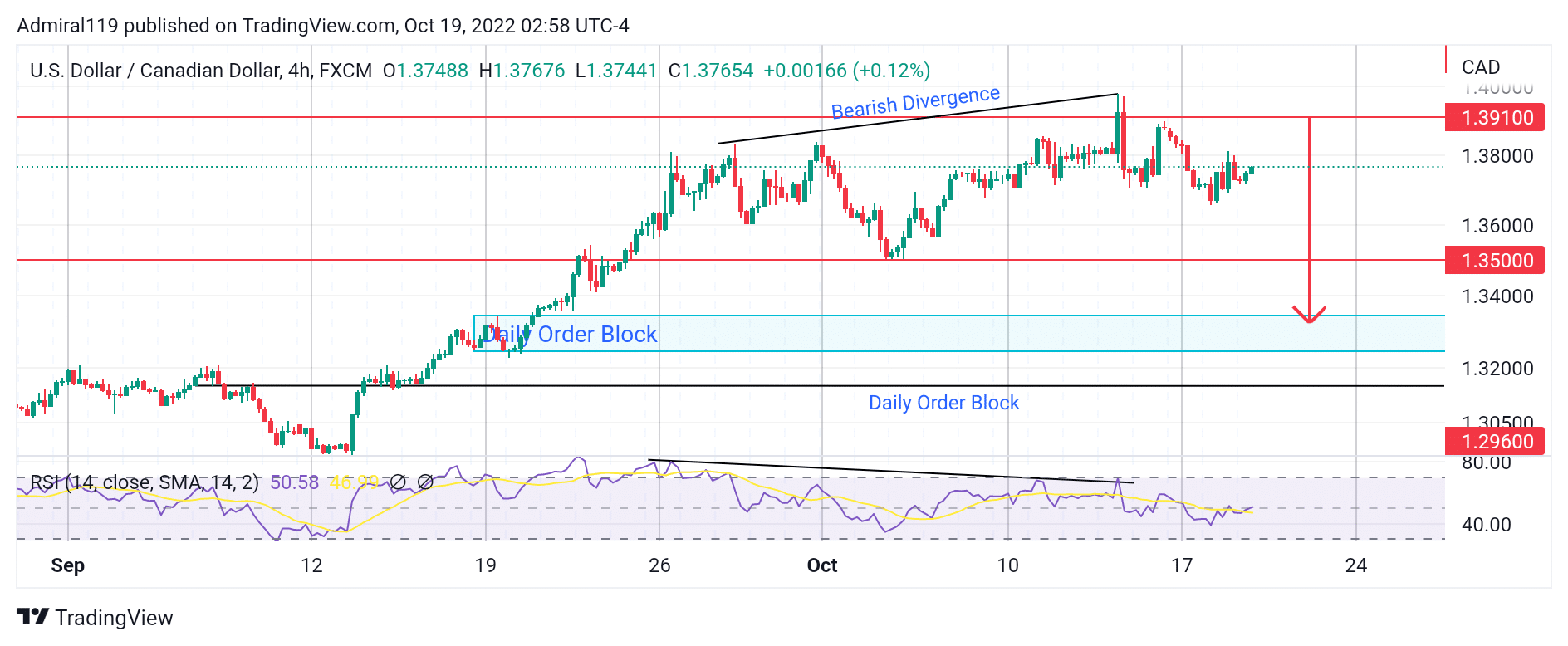

Market Expectation

Following the failure swing and the market structure shift on the four-hour chart, the market’s current direction is bearish. The USDCAD sellers are expected to further crash the market down until either of the daily order blocks is reached.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.