USDCAD Analysis – November 9

USDCAD seeks lower prices for buy orders in the discount zone. While the overall outlook of the market is bullish on the higher timeframe, the bears currently seem privileged to open short positions after the supply zone at 1.3980 was reached.

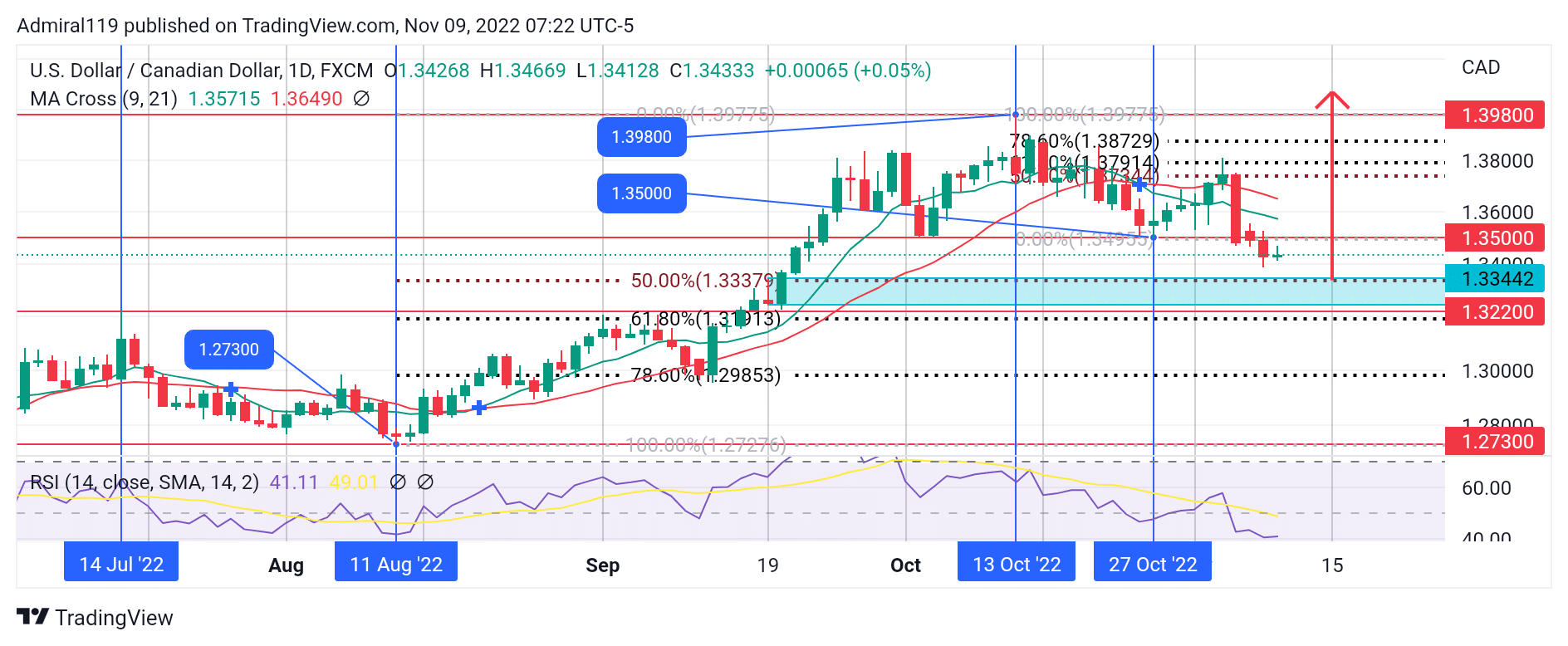

USDCAD Significant Zones

Demand Zones: 1.3220, 1.2730

Supply Zones: 1.3500, 1.3890

USDCAD Long-term Trend: Bullish

The movement of the market has been so sloppy to the upside that the Relative Strength Index never entered the oversold region for the past few months. Before USDCAD entered the 1.3980 supply zone, the last time the bears had a nice opportunity to short the market was on the 14th of July, 2022. The opportunity lasted for seventeen trading days, which was quite enough for an extremely sloppy uptrend.

On the 11th of August, when the retracement ended, the price surged upward in response to the piles of buy orders at the 1.2730 demand zone. From the demand zone, the bulls kept placing long orders until USDCAD became overbought in September 2022.

The current trading range low and high were marked by the price levels of 1.2730 and 1.3980, respectively. In a bid for the bears to get opportunities to the downside in the market, sell orders were placed at significant resistance levels, thereby instigating retracements at such levels.

USDCAD continued upwards, rapidly and in fractals, until the selling pressure at the 1.3980 supply zone overwhelmed the bulls’ buy orders. Now it appears the bears are in control of the market, but this downtrend might not last beyond the 50% retracement level.

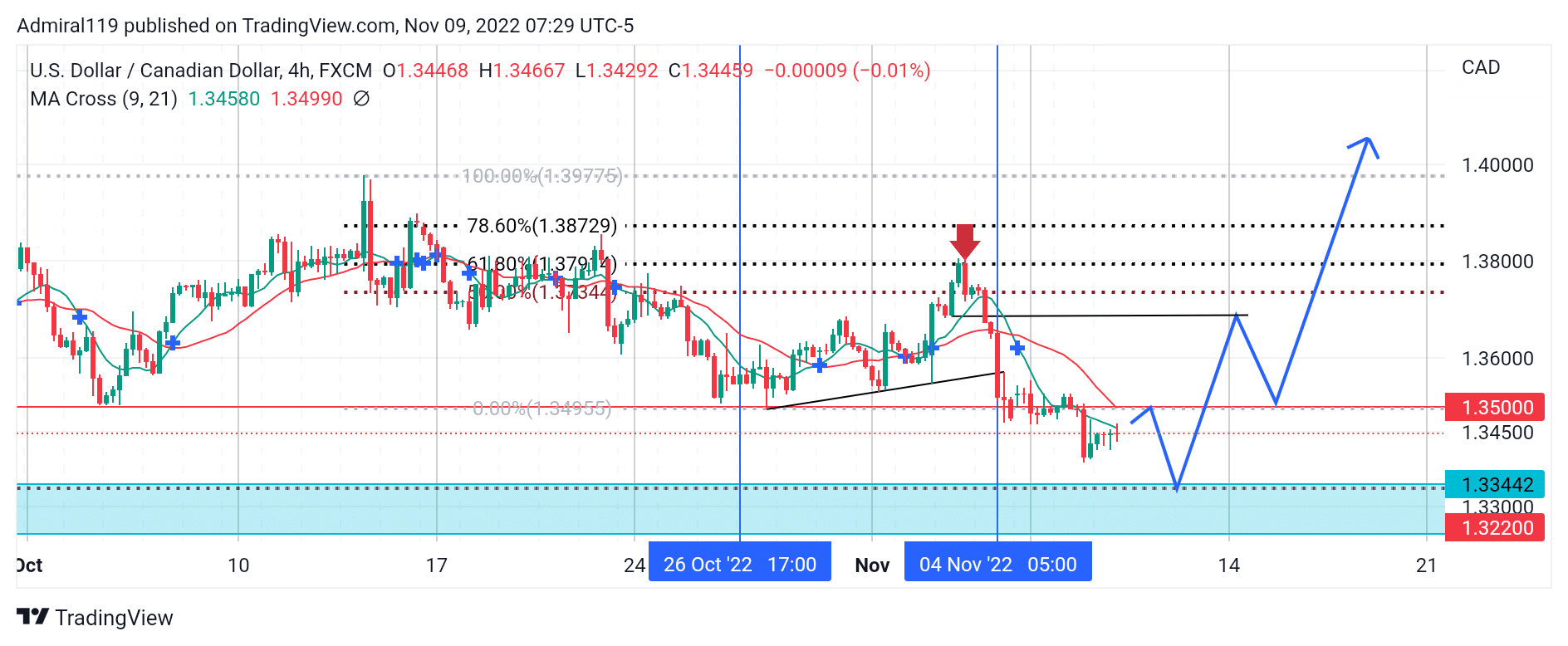

USDCAD Short-term Trend: Bearish

After hitting the 61.8% Fibonacci retracement level, USDCAD flipped bearish alongside the MA Cross on the four-hour chart. Price seems to be heading into the daily bullish order block, after which an expansion to the upside will likely commence.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.