USDCAD Analysis – November 30

USDCAD remains bullish as the Moving Average indicator signals buy. A bullish order block emerged as the price was delivered to the upside on September 19, 2022, in an attempt to keep the market’s order flow bullish.

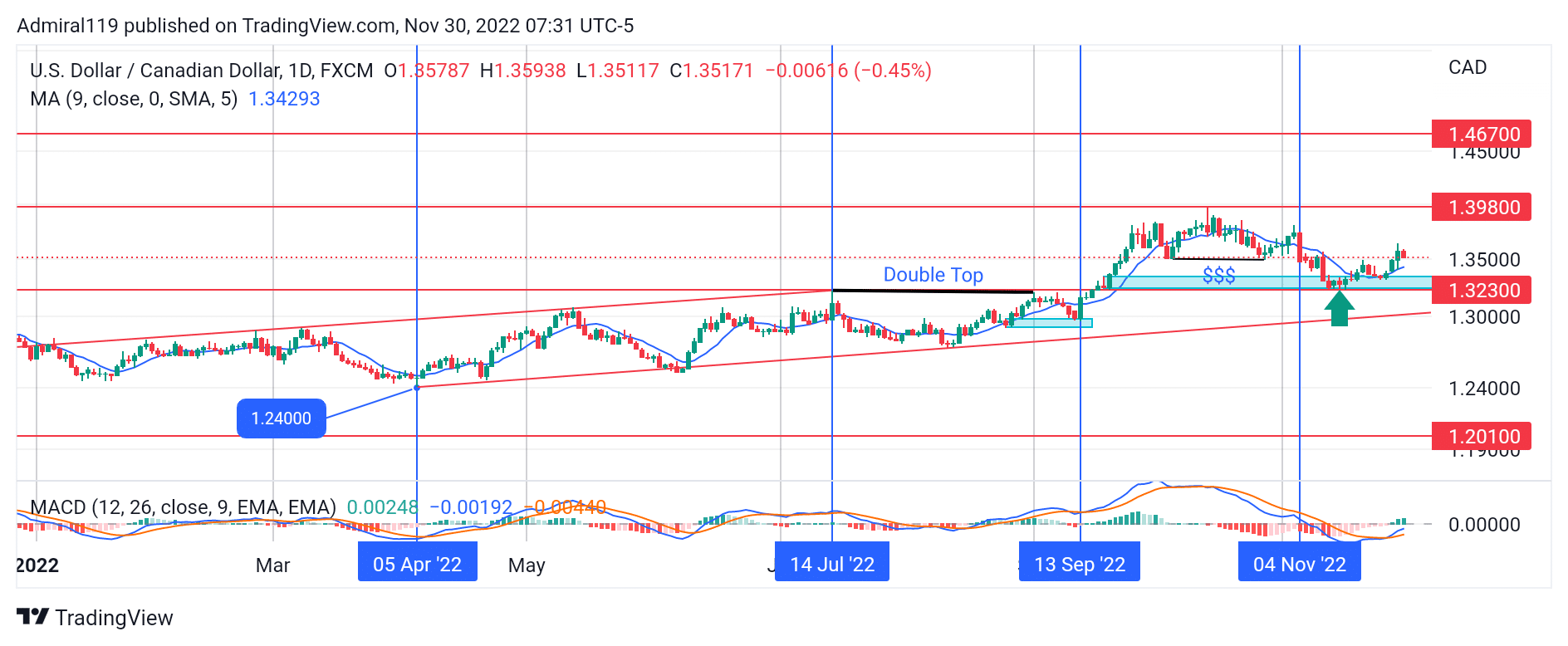

USDCAD Significant Zones

Demand Zones: 1.3230, 1.2010

Supply Zones: 1.3980, 1.4670

USDCAD Long-term Trend: Bullish

The bullish order block that formed during the price delivery to the upside on September 19, 2022, is currently the reason for the ongoing wave expanding towards the high of USDCAD. The Moving Average Convergence Divergence (MACD) is currently rallying toward the zero line, which indicates a continuation of the bullish trend. The major trendline is currently holding prices to the upside. The major trendline emerged when the price reached its local low of 1.2400 on April 5, 2022. A lot of selling pressure would be needed to invalidate the major trendline. On September 1, 2022, a double top was formed with a daily high of July 14, 2022.

The double top was invalidated in less than two weeks due to the selling pressure at the daily bullish order block. On September 13, 2022, a bullish marubozu candlestick was used to run through the buy-side liquidity above the double top. Similarly, a bearish marubozu was created to grab liquidity below the double bottom on November 4, 2022. While the bulls appear to be in control of the market, the bearish order block that formed as the price crashed from the 1.3980 resistance could cause the downfall of USDCAD.

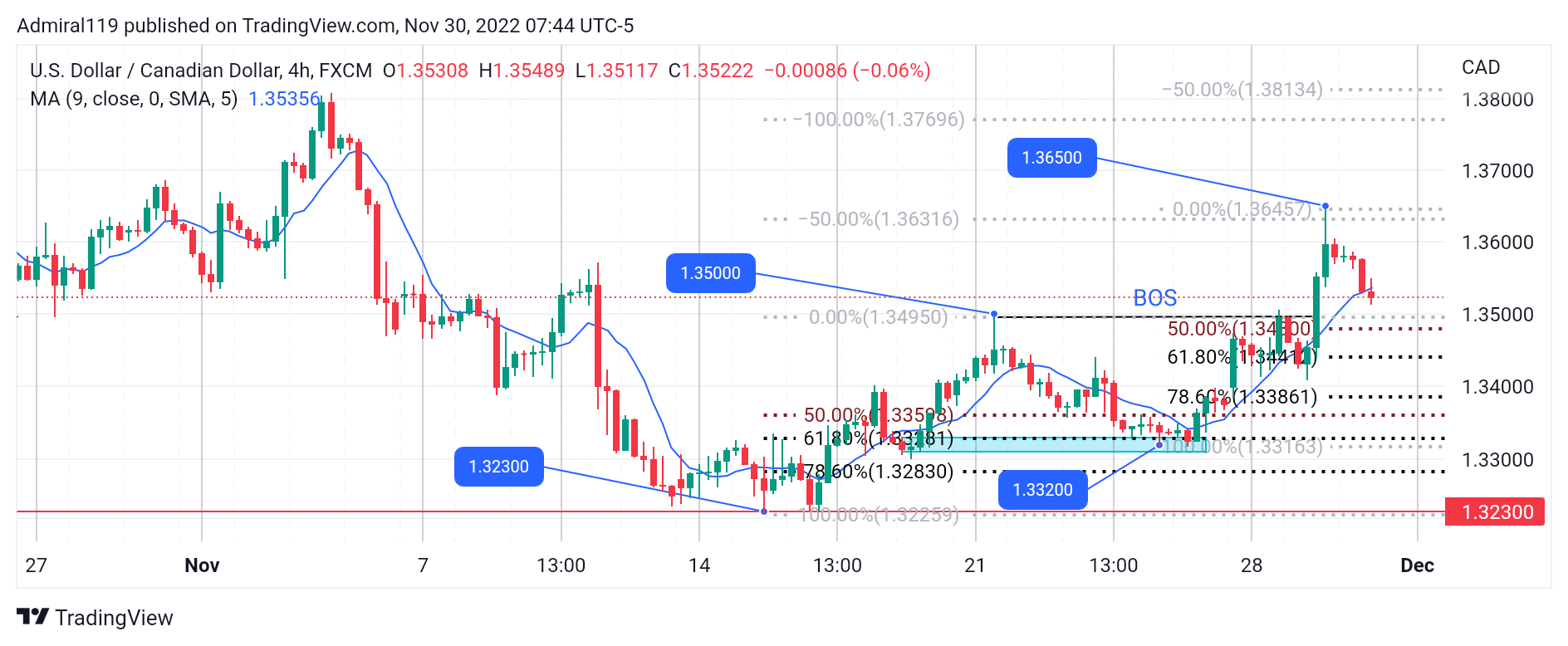

USDCAD Short-term Trend: Bullish

Coming from the discount of the previous trading range, the market ascends upward with higher highs and higher lows on the four-hour chart. The current trading range is defined by the 1.3320 and 1.3650 price levels. USDCAD is expected to seek buy orders at the discount before resuming the upward trend.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.