USDCAD Analysis – November 16

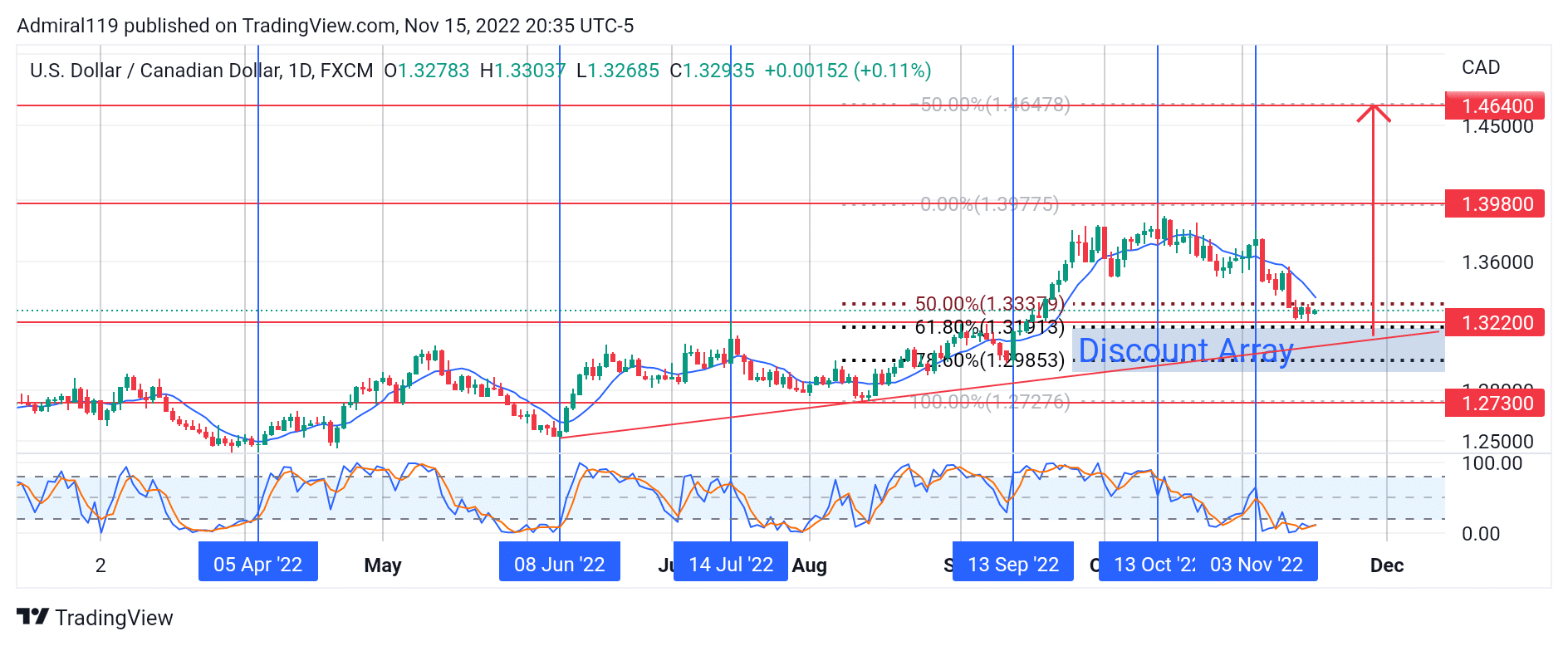

USDCAD bulls find re-entry at a discount array. The market’s overall direction still aligns with the major trendline on the daily time frame. The trendline has been opposing the bears as they look downward. The recent pullback to the downside was due to the downcasting of USDCAD by its sellers at the 1.3980 supply zone.

USDCAD Significant Zones

Demand Zones: 1.3220, 1.2730

Supply Zones: 1.3980, 1.4640

USDCAD Long-term Trend: Bullish

The major trendline became noticeable on the daily chart after a few rejections. On June 8, 2022, the price was beaten back upward to begin a clear uptrend in the market in favor of the USDCAD bulls. Ever since, USDCAD has been ascending across the trendline, with its swing lows touching the trendline. In essence, the trendline has served as a significant diagonal support for market participants. Just two months before the first bounce on the trendline, the market attained its local low at a discount. As of now, it will take a massive crash and unmatchable selling pressure to reach this local low.

On July 14, 2022, the USDCAD bulls successfully drove price into the 1.3220 previous supply zone, but on this same day, the USDCAD sellers contentiously hijacked the trend and caused turmoil until September 13, 2022. The pullback at the 1.2730 demand zone and the rising trendline aroused the USDCAD bulls, and they stormed the market when the buy signal was given by the moving average (MA). On this same day, the price was delivered to the upside after a succession of bearish candlesticks. This delivery to the upside formed the bullish order block, which might eventually cause the resumption of the bull run from the discount array.

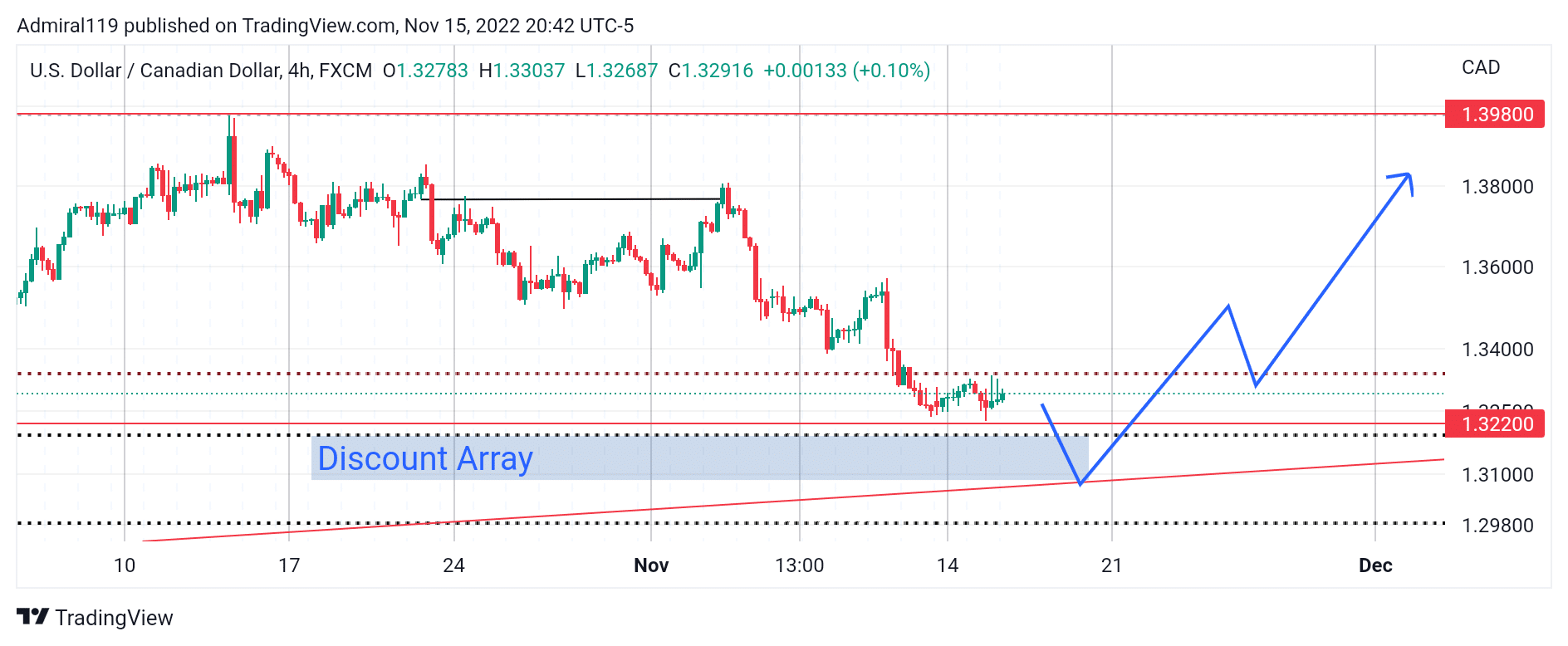

USDCAD Short-term Trend: Bearish

Following the rebuff at the 1.3980 supply zone, USDCAD has been facing downward on the four-hour time frame, with successive breaks of structure to the downside. USDCAD bulls will likely resume the uptrend as soon as the discount array is reached.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.