USDCAD Analysis – October 26

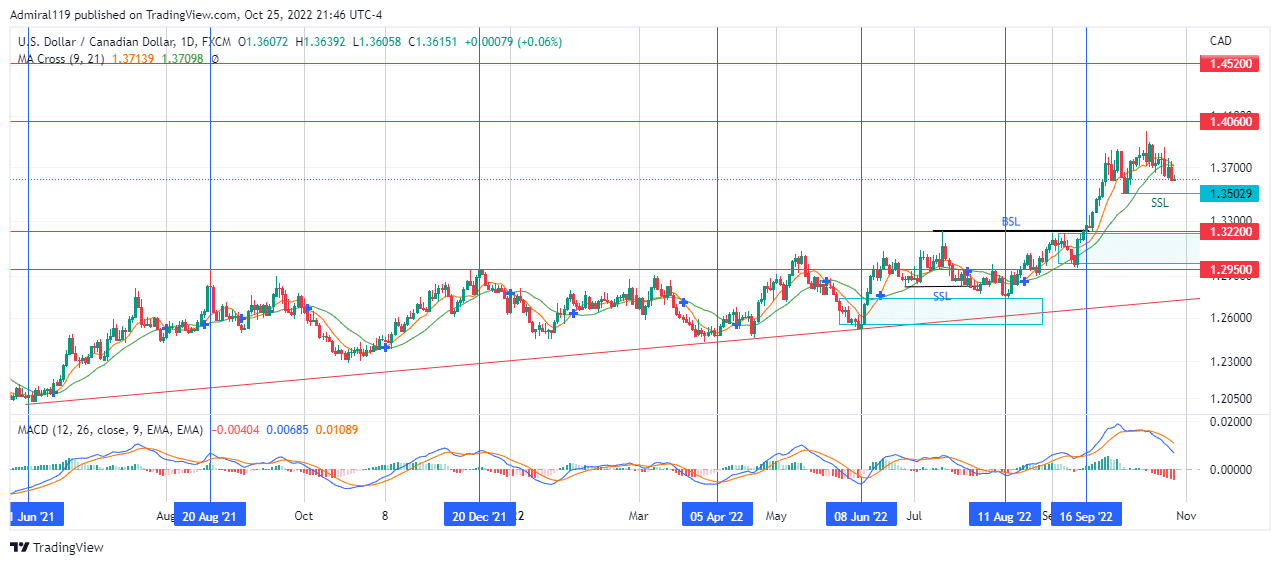

USDCAD bears storm the market as the MACD heads downward. Though with obvious resistance, the bulls have been quite dominant in the market since June 1st, 2021. For over one year, the intention of the bulls to break the 1.2950 resistance could be seen as they tremendously hit it at every single opportunity from below.

USDCAD Significant Zones

Demand Zones: 1.3220, 1.2950

Supply Zones: 1.4060, 1.4520

USDCAD Long-term Trend: Bullish

An ascending trendline began its course on June 1st, 2021. As prices kept skyrocketing into the previous supply zone at 1.2950, the USDCAD bears aimed for entry at the 1.2950 level. On the 20th of August, 2021, some sell orders got filled and the price retraced downward for a short period. An expansion back into the 1.2950 supply zone got more sell orders filled and the price plunged downward to hit the trendline support. The reaction at the trendline caused the price to break through the 1.2950 level, but this was just a ruse as the market returned to its range.

On the 8th of June, 2022, prices rallied aggressively out of the range to hit the 1.3220 previous resistance. The low created during this rally was invalidated to grab sell-side liquidity as the price headed into the weekly bullish order block. Shortly after the sell-side liquidity was taken and the bullish order block was hit, the 1.3220 previous resistance was broken aggressively by the USDCAD buyers. Currently, the MACD is heading downward; this shows the intention of the bears to sink the price downward.

USDCAD Short-term Trend: Bullish

The directional bias of USDCAD on the four-hour chart is downward. But the market’s environment won’t be uncontroversially bearish until the old low at 1.35029 is broken downward. Once this old low is broken, the bears are expected to sink the price further down into a discount.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.