USD/JPY plunged in the short term after reaching the 110.96 level. It has dropped as the USDX and JP225 have decreased as well. Still, the current correction could be only a temporary one.

The US Dollar Index is into a corrective phase which could end tonight after the FOMC Meeting Minutes. A new leg higher registered by the USDX could boost USD/JPY.

On the other hand, JP225 (Nikkei) is trapped within a potential continuation pattern. So, Nikkei maintains a bullish outlook, further growth could weaken the Yen again.

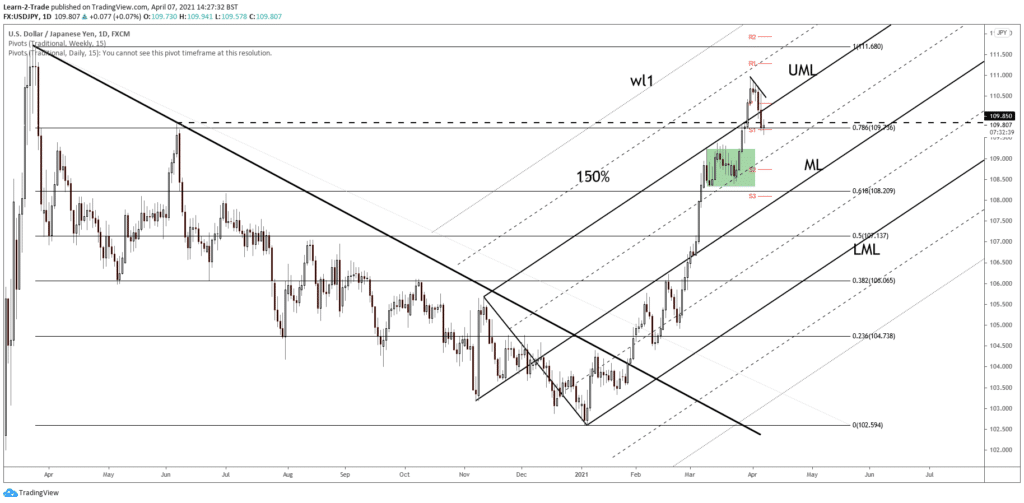

USD/JPY Daily Chart Analysis!

USD/JPY has come back below the ascending pitchfork’s upper median line (UML). Now is pressuring the weekly S1 (109.68) and the 78.6% level. We have a strong support area around these levels.

A false breakdown with great separation below the S1 or a major bullish engulfing could signal a new upside momentum. The outlook is bullish, so we could search for new long opportunities when the retreat ends.

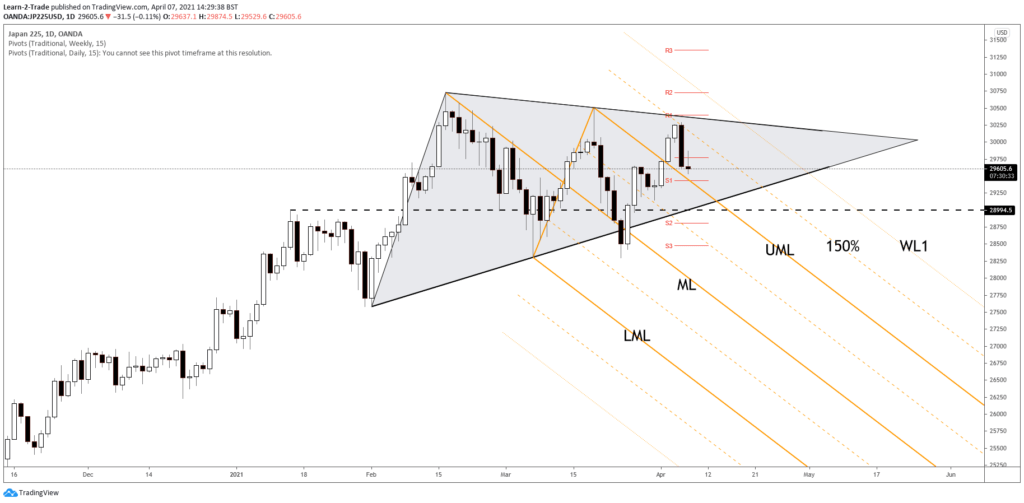

Nikkei Daily Chart Analysis!

JP225 has decreased from the 150% Fibonacci line and now it could reach and retest the upper median line (UML). The most recent false breakdown below the triangle’s support signals strong buyers.

It could continue to move sideways in the short term before registering an upside breakout. Moving higher again should force the Yen to depreciate versus its rivals.

If you want to receive the USD/JPY buying signal just subscribe to the VIP channel HERE

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.