Market Analysis – January 8

The USD/CAD pair remains underpinned by a steady US Dollar and persistent weakness in the Canadian Dollar, as diverging macroeconomic forces continue to shape price action. On the US side, the Dollar has found short-term stability following a series of mixed economic releases that keep the Federal Reserve firmly in a cautious, data-dependent stance. While signs of improving momentum in the US services sector suggest resilience in economic activity, softer labor market indicators reinforce expectations that policymakers will proceed carefully as they assess the timing and pace of potential rate cuts later in the year.

USD/CAD Key Levels

Demand Levels: 1.3900, 1.4000, 1.4100

Supply Levels: 1.40000, 1.41000, 1.42000

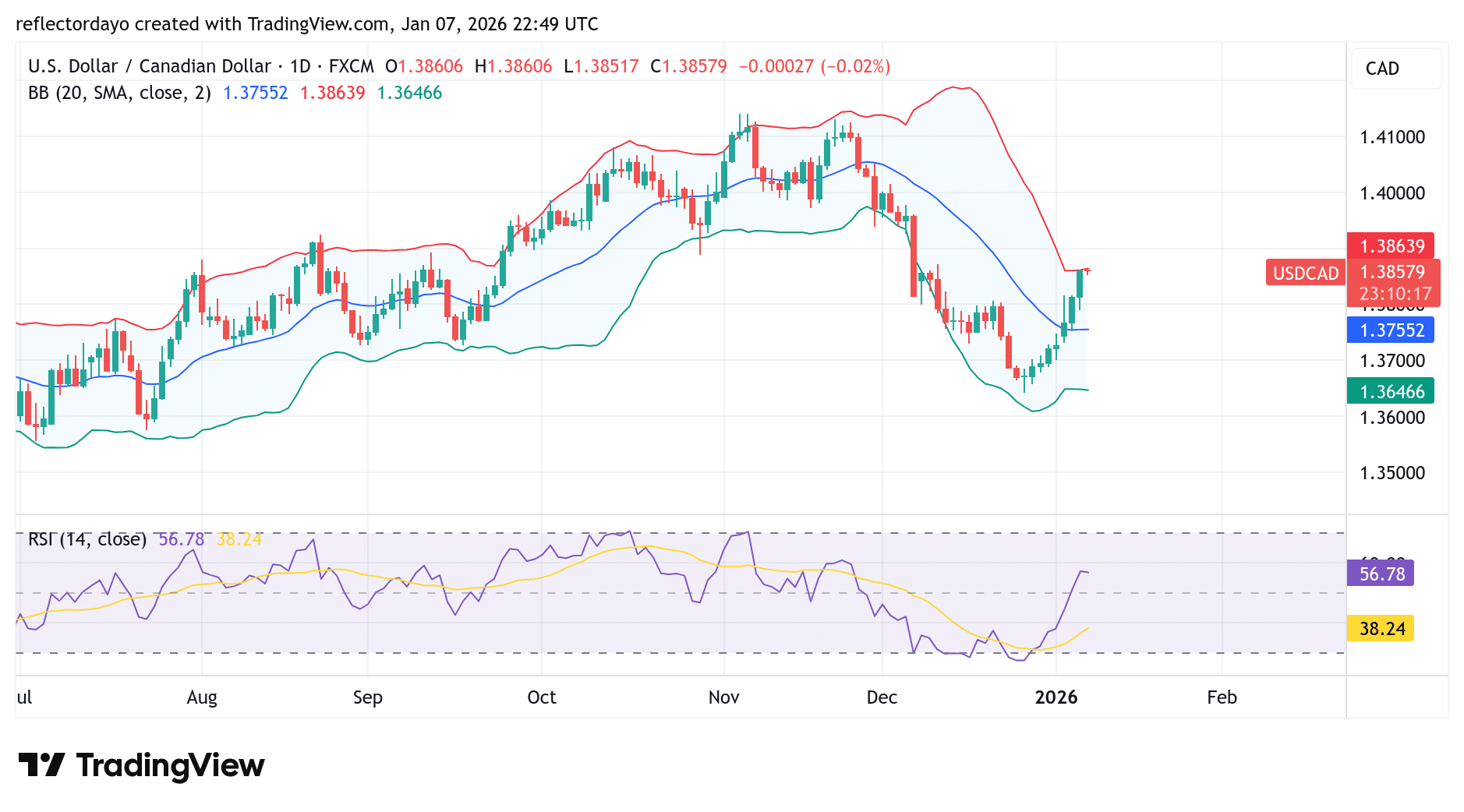

USD/CAD Recovers as Price Rebounds

A key support zone near the 1.3600 price level continues to underpin the ongoing bullish recovery in USD/CAD. The rebound has already passed its first major test at the 1.3800 resistance level, which the market successfully broke and sustained above. This move confirmed renewed bullish interest and strengthened upside momentum.

However, as the price advanced toward the 1.3900 psychological level, traders began to exercise caution. This hesitation has caused price action to stall around the 1.3856 area, where buying and selling pressure appear evenly matched. The emergence of a doji candlestick at this level reflects market indecision and a temporary pause in momentum.

For the bullish recovery to remain intact and extend toward 1.3900, the market will need to break decisively above this near-term resistance zone. Until then, USD/CAD may continue to consolidate as traders assess the next directional move.

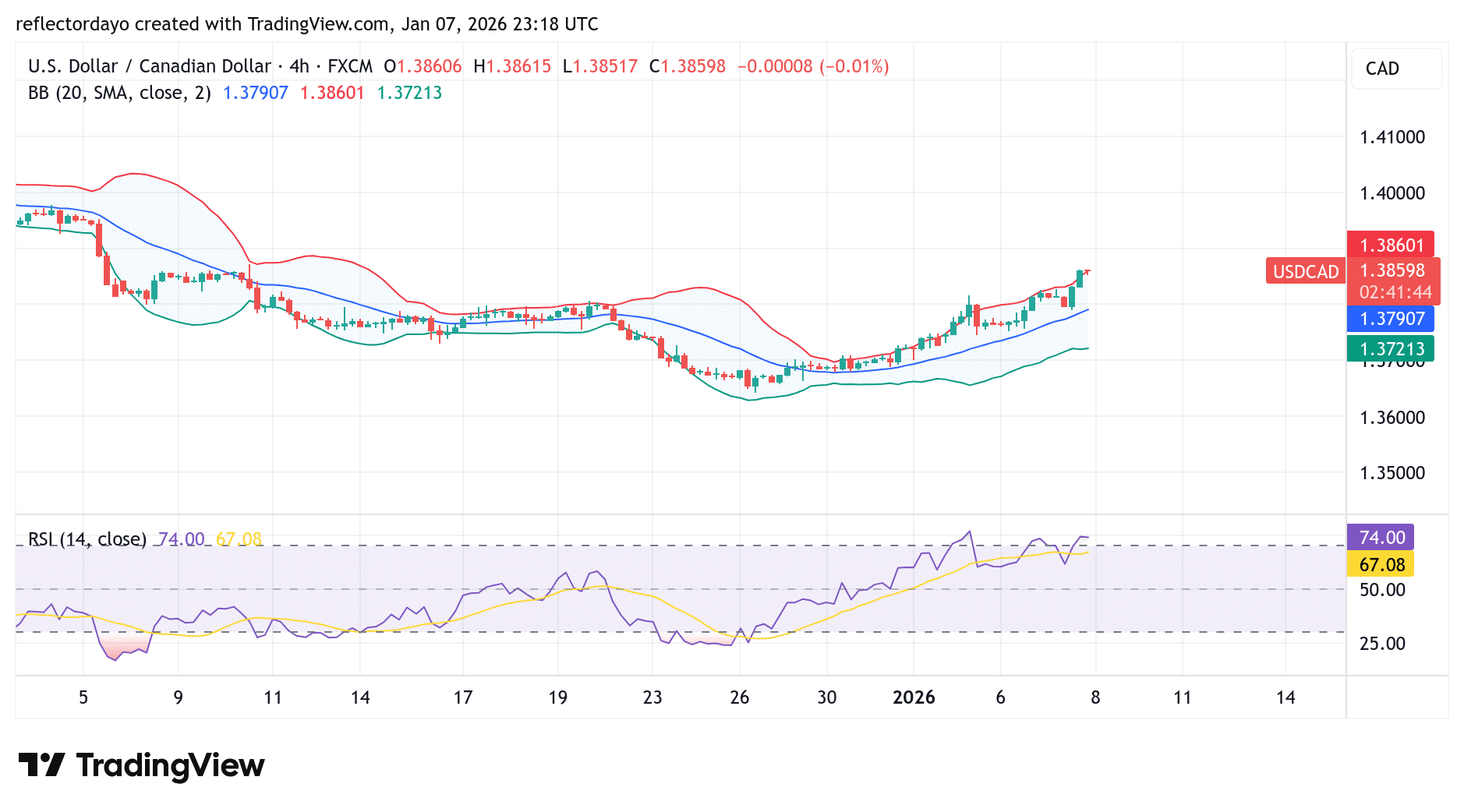

USD/CAD Short-Term Trend

USD/CAD has reached a key near-term level around 1.3856, where the ongoing bullish recovery is facing a significant test. Momentum has slowed at this area, suggesting that buyers are becoming more cautious.

The Relative Strength Index (RSI) is hovering near 73, indicating overbought conditions. This raises the possibility of a short-term corrective pullback, as price may need to cool off before attempting another upward move.

If a correction does materialize from the 1.3856 region, the 1.3800 level is expected to act as a crucial support zone and a potential re-entry area for bulls. A successful hold above this level would help preserve the broader bullish structure and keep the door open for a renewed push higher.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.