US30 Analysis – August 19

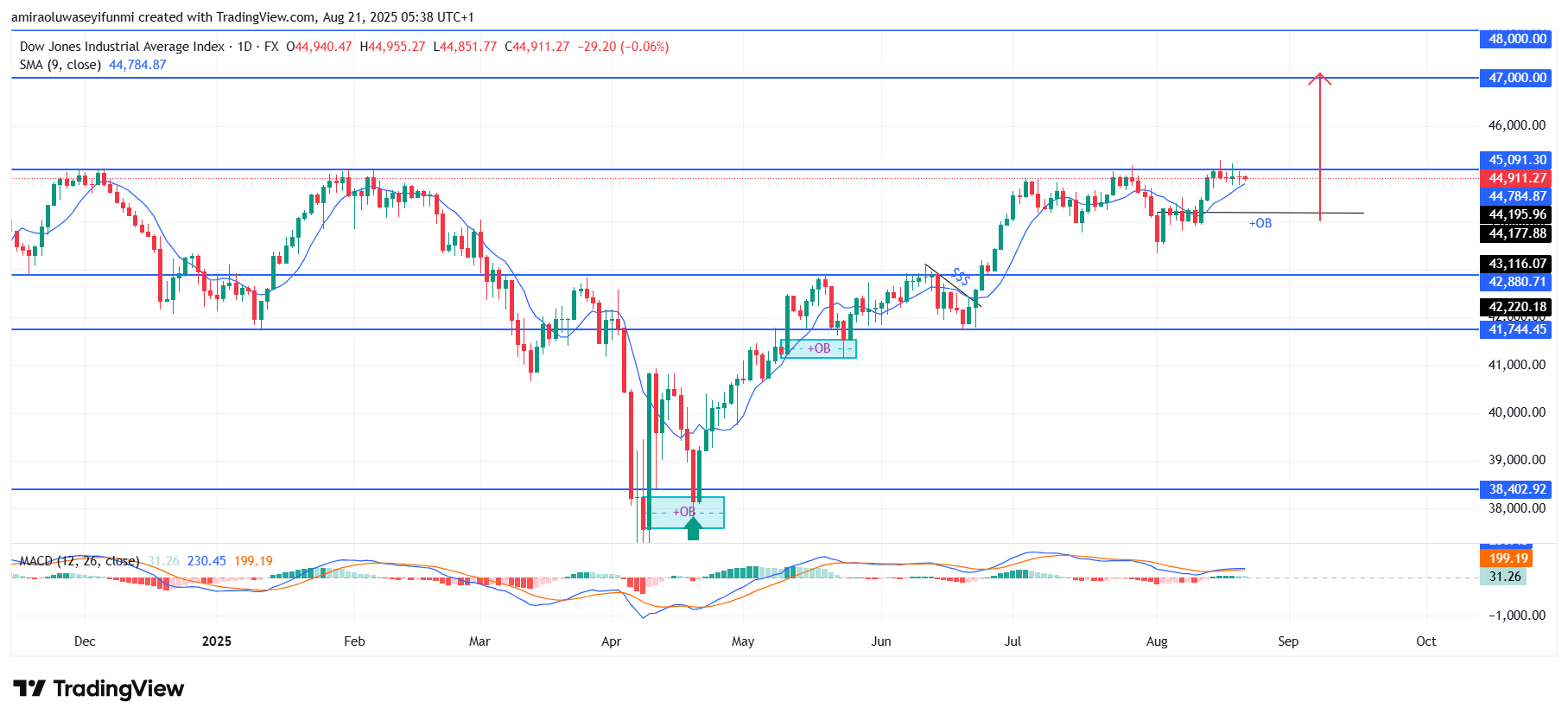

US30 sustains its uptrend with prospects for higher valuation levels. The index continues to demonstrate bullish momentum, supported by its sustained position above the 9-day SMA, currently at $44,790. Since rebounding from April lows near $38,400, US30 has maintained a steady upward trajectory, with the MACD holding in positive territory to reinforce market strength. The consistent formation of higher highs and higher lows confirms an ongoing demand-driven rally, keeping sentiment favorable for buyers.

US30 Key Levels

Resistance Levels: $45,100, $47,000, $48,000

Support Levels: $42,880, $41,740, $38,400

US30 Long-Term Trend: Bullish

From a technical perspective, price has respected key demand blocks around $44,180 and $42,880, which now serve as strong support areas. Recent price action has shown resilience near the $45,000 handle, where buyers have actively defended against pullbacks. This consolidation just below resistance reflects a market gathering momentum, with institutional flows likely favoring continued upside movement.

Looking ahead, US30 is expected to break above the $45,090 resistance region, paving the way for a projected climb toward $47,000. A confirmed breakout would then expose the $48,000 mark as the next major upside target. As long as supports at $44,180 and $42,880 remain intact, the broader outlook continues to favor sustained bullish expansion toward higher valuation levels.

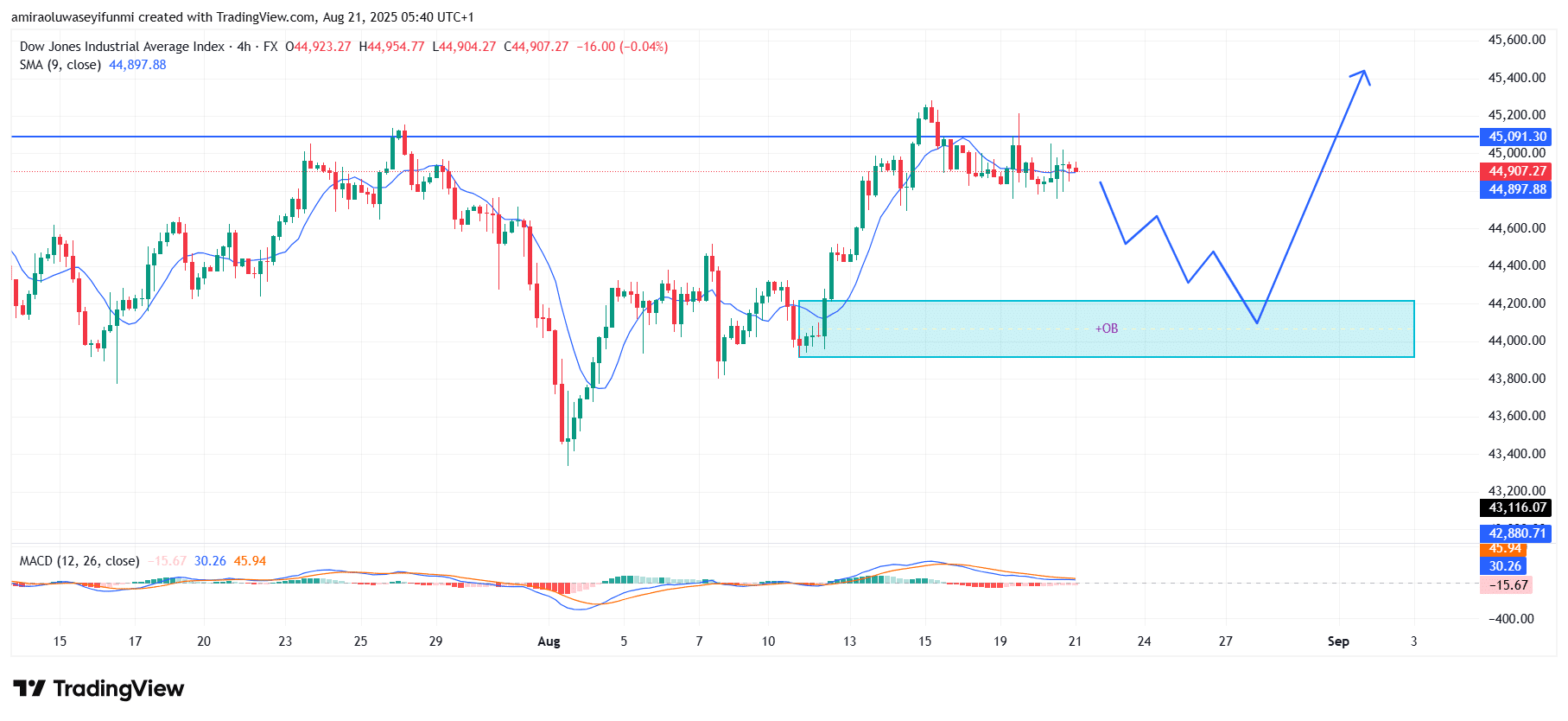

US30 Short-Term Trend: Bullish

Currently, US30 is consolidating below resistance at $45,100 after facing rejection near this level. Price action indicates a possible retracement toward the order block zone around $44,000–$44,200 before a rebound.

The MACD reflects weakening momentum in line with the corrective structure. However, if buyers defend the order block, US30 could resume its bullish trend toward $45,400. Traders monitoring forex signals may find opportunities to align with this continuation setup.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.