US30 Analysis – January 13

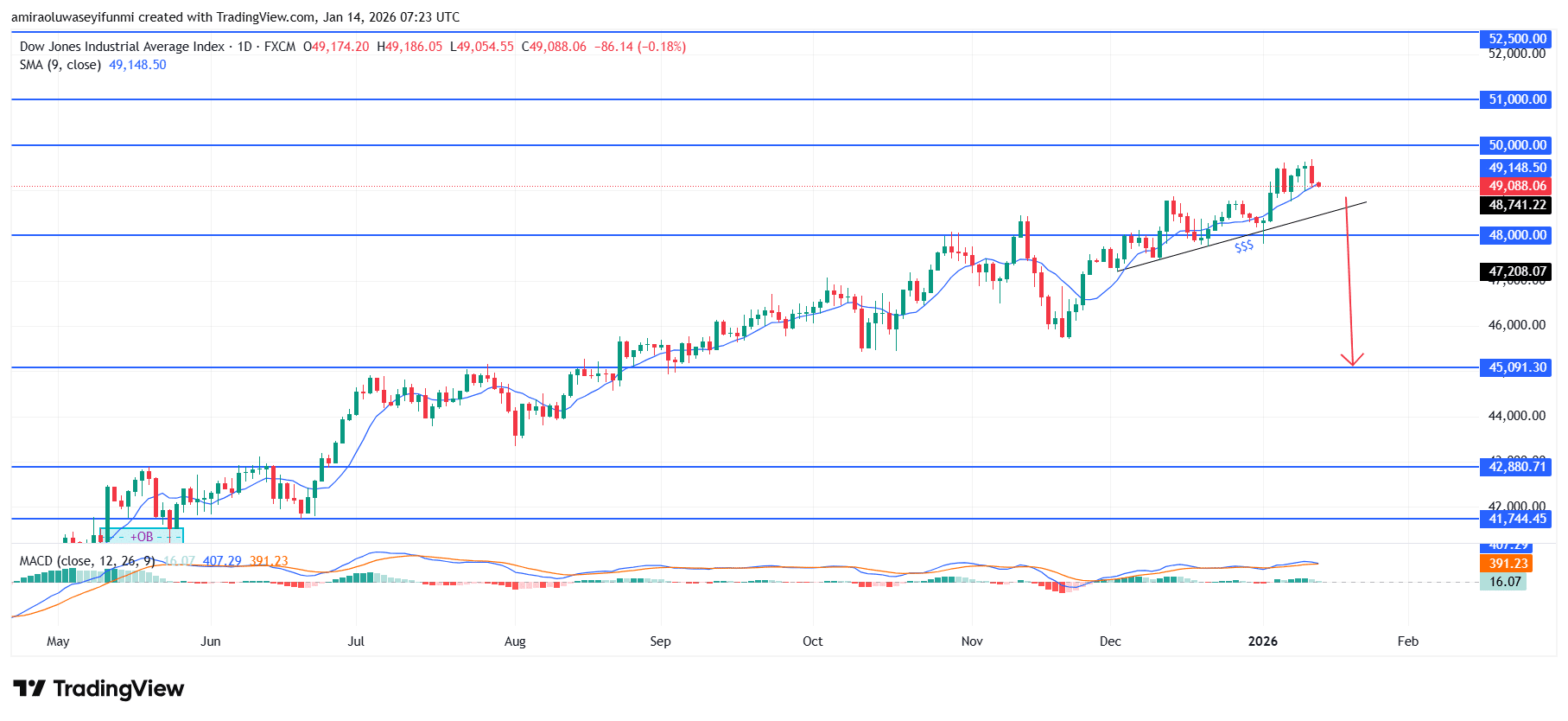

US30 signals downside transition as bullish drive loses strength. US30 is starting to reflect a shift in directional balance as upside momentum shows clear signs of fatigue near recent highs. Although price continues to hover above the short-term moving average around $49,150, indicator alignment suggests slowing internal strength rather than trend continuation. The MACD’s loss of slope and subdued histogram activity point to weakening buying conviction, increasing the likelihood of a corrective phase taking shape.

US30 Key Levels

Resistance Levels: $50000, $51000, $52500

Support Levels: $48000, $45090, $42880

US30 Long-Term Trend: Bearish

From a technical perspective, price action has become increasingly constrained following repeated failures to establish value above the $49,800–$50,000 supply band. The index is consolidating near the upper boundary of its prior advancing structure, with the $48,700 to $48,000 region acting as a fragile near-term base. A rising trendline beneath current levels adds structural pressure, as a decisive break would signal a meaningful shift in market control rather than routine consolidation.

Looking ahead, a confirmed move below $48,000 would likely attract stronger sell-side participation, exposing the $45,100 area as the next downside objective. If that level fails to generate sufficient demand, extended weakness could drive price toward the $42,880 support zone. In the absence of a sustained recovery above $50,000, the broader outlook remains skewed toward a deeper bearish adjustment.

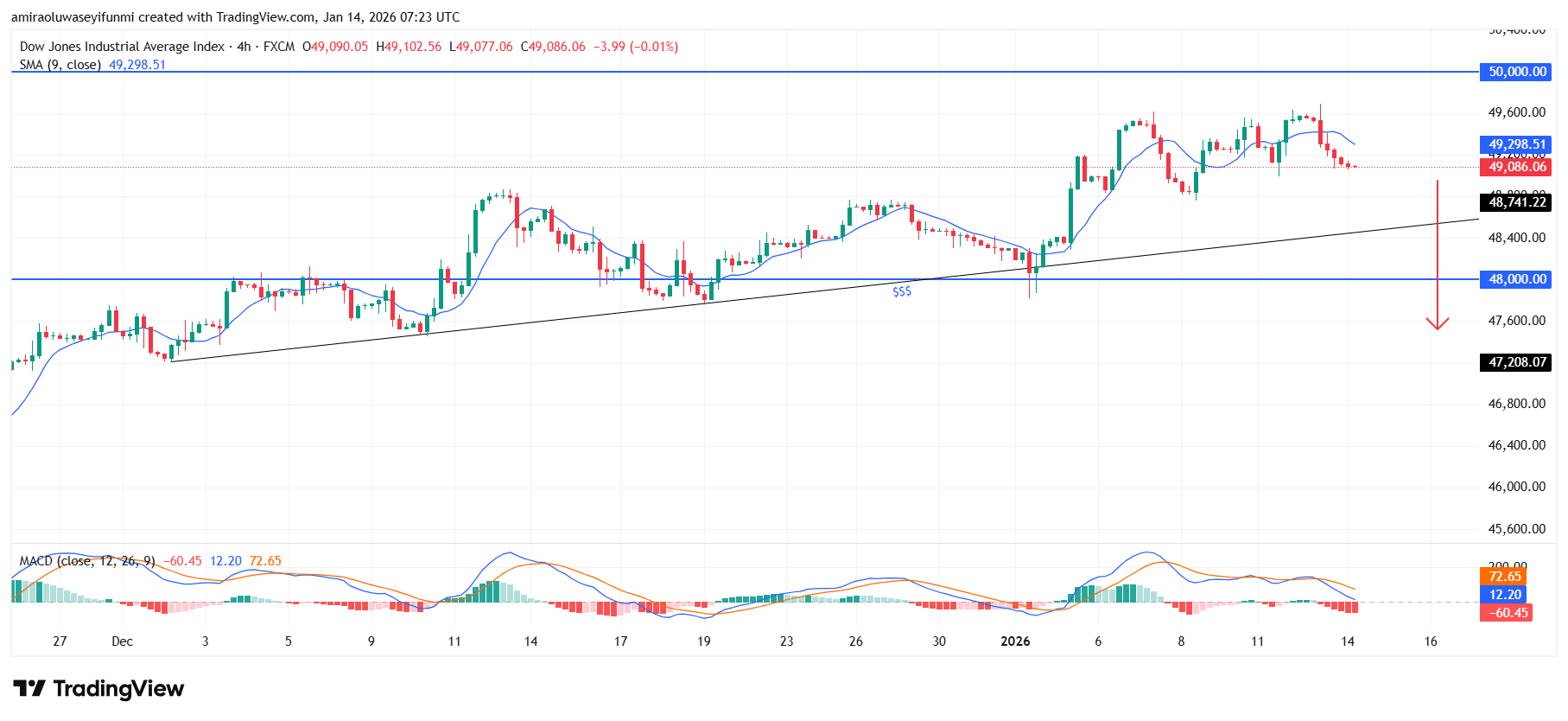

US30 Short-Term Trend: Bearish

US30 on the four-hour chart is showing a bearish transition as price trades below the 9-period moving average, signaling weakening short-term momentum. The recent rejection from the $49,300 to $49,600 zone highlights strong overhead supply and fading bullish follow-through.

Price is also gravitating toward a retest of the rising trendline and the $48,000 support area, which now serves as a key downside magnet. With MACD momentum rolling over below the signal line, near-term forex signals continue to favor a deeper corrective move within the broader bearish structure.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.