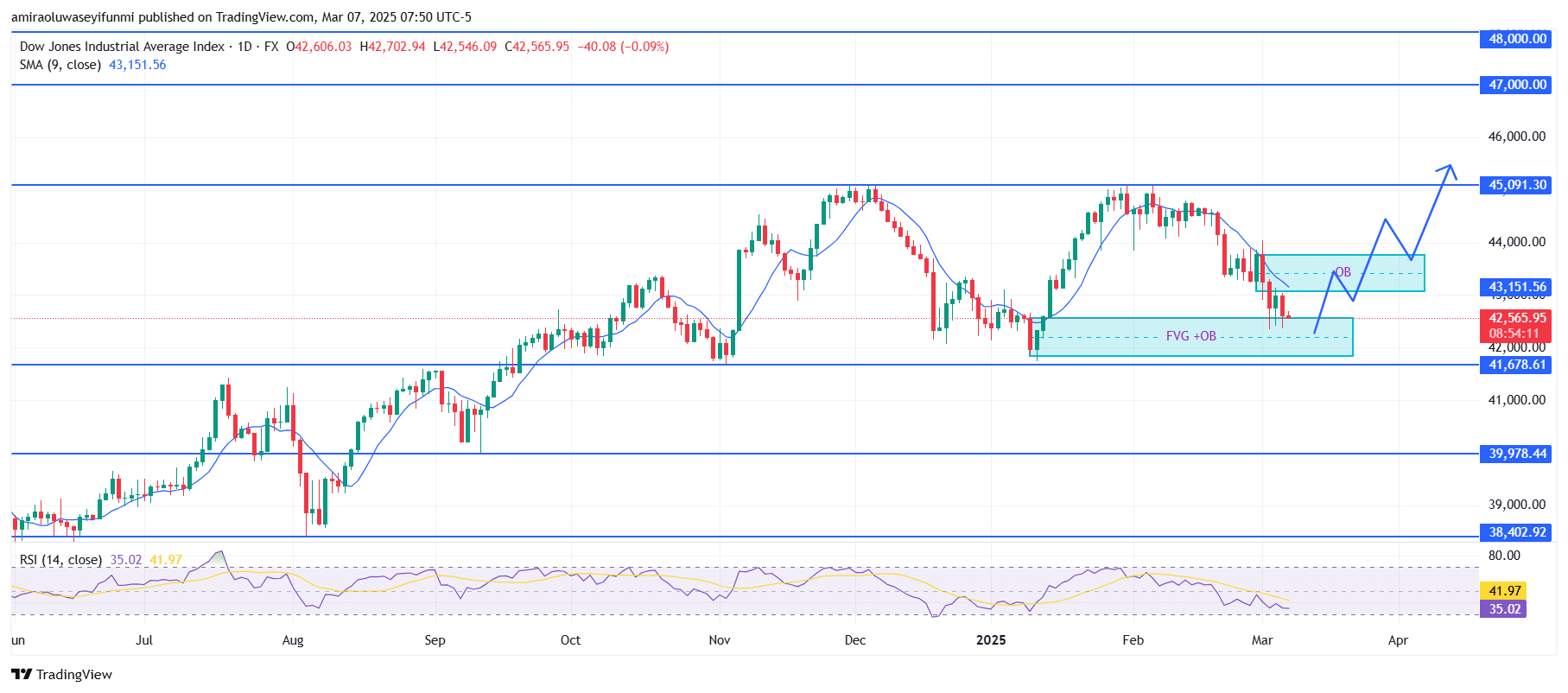

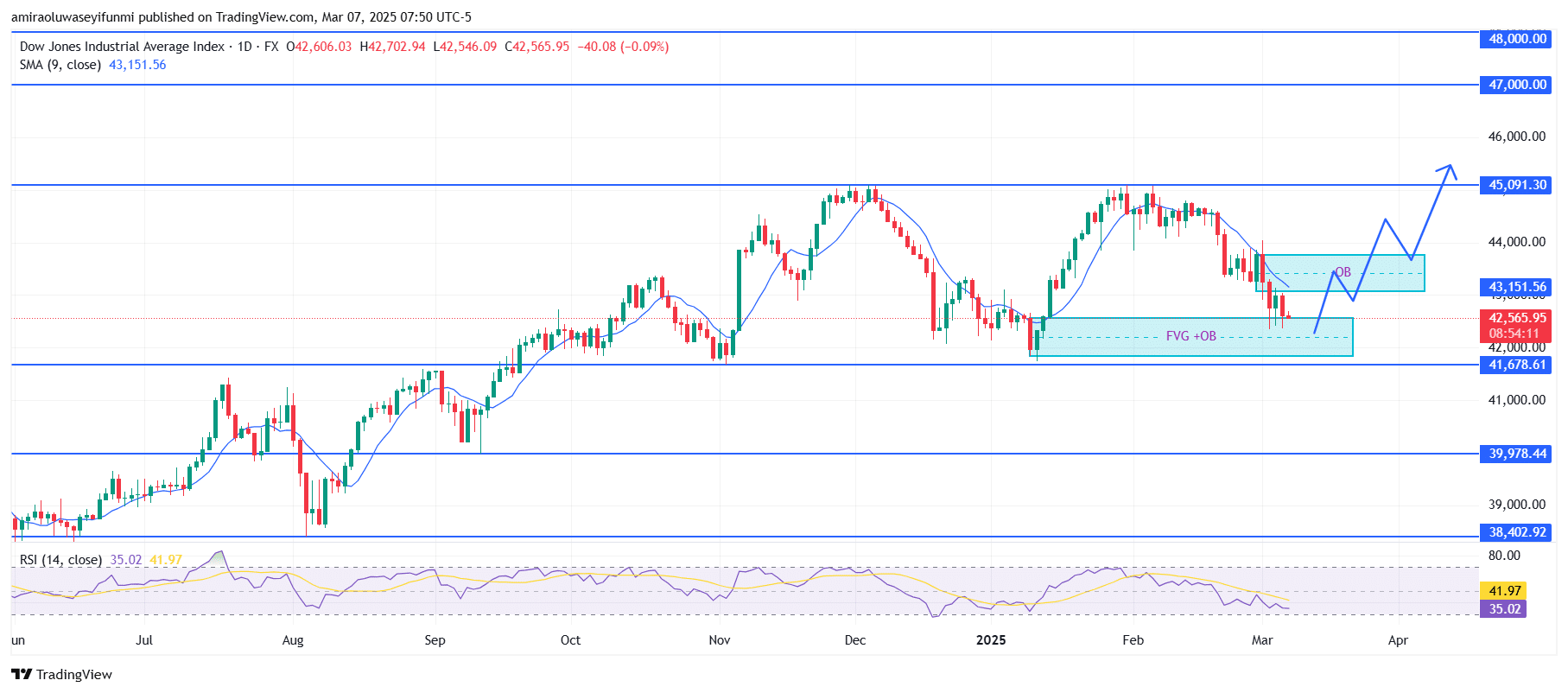

US30 Analysis – March 4

US30 demonstrates bullish potential after maintaining a critical support level. Indicators suggest a strong possibility of a bullish reversal. The 9-period Simple Moving Average (SMA) at $43,150 indicates that the market remains in a short-term downtrend; however, the price is currently rebounding from a demand zone. The Relative Strength Index (RSI) stands at 35.00, close to the oversold territory, signaling that selling pressure may be weakening, allowing buyers to step in. A bullish divergence between the RSI and price could further reinforce the case for an upward movement.

US30 Key Levels

Resistance Levels: $45,100, $47,000, $48,000

Support Levels: $41,700, $40,000, $38,400

US30 Long-Term Trend: Bullish

The market has responded to a significant Fair Value Gap (FVG) and Order Block (OB) within the $42,000 to $41,680 range. This suggests that institutional players may have accumulated positions in this area, potentially driving a rally. The price structure currently exhibits a series of lower highs and lower lows, but this pattern could soon shift if the price reclaims the supply zone near $43,150 and establishes it as support. A successful breakout above this level would further validate the bullish outlook.

The US30 is expected to rise, with $45,100 acting as the first major resistance level. If this level is surpassed, the market may target $47,000 and, eventually, $48,000. After testing the $43,150 zone, the price is likely to pull back slightly before forming a higher low and pushing higher. The bullish perspective remains intact as long as the market holds above the $41,700 support level.

US30 Short-Term Trend: Bullish

With the 9-period SMA at $42,620 acting as immediate resistance, the US30 is currently trading near a crucial support level at $42,160. The RSI at 39.80 indicates that the market is approaching oversold conditions, increasing the likelihood of a bullish reversal. A decisive breakout above $42,620 could signal a move toward the $45,100 resistance level. The bullish sentiment, aiming for higher levels in the coming sessions, remains valid as long as the price stays above $41,700. Additionally, traders may consider forex signals to capitalize on potential market movements.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.