US30 Analysis – November 25

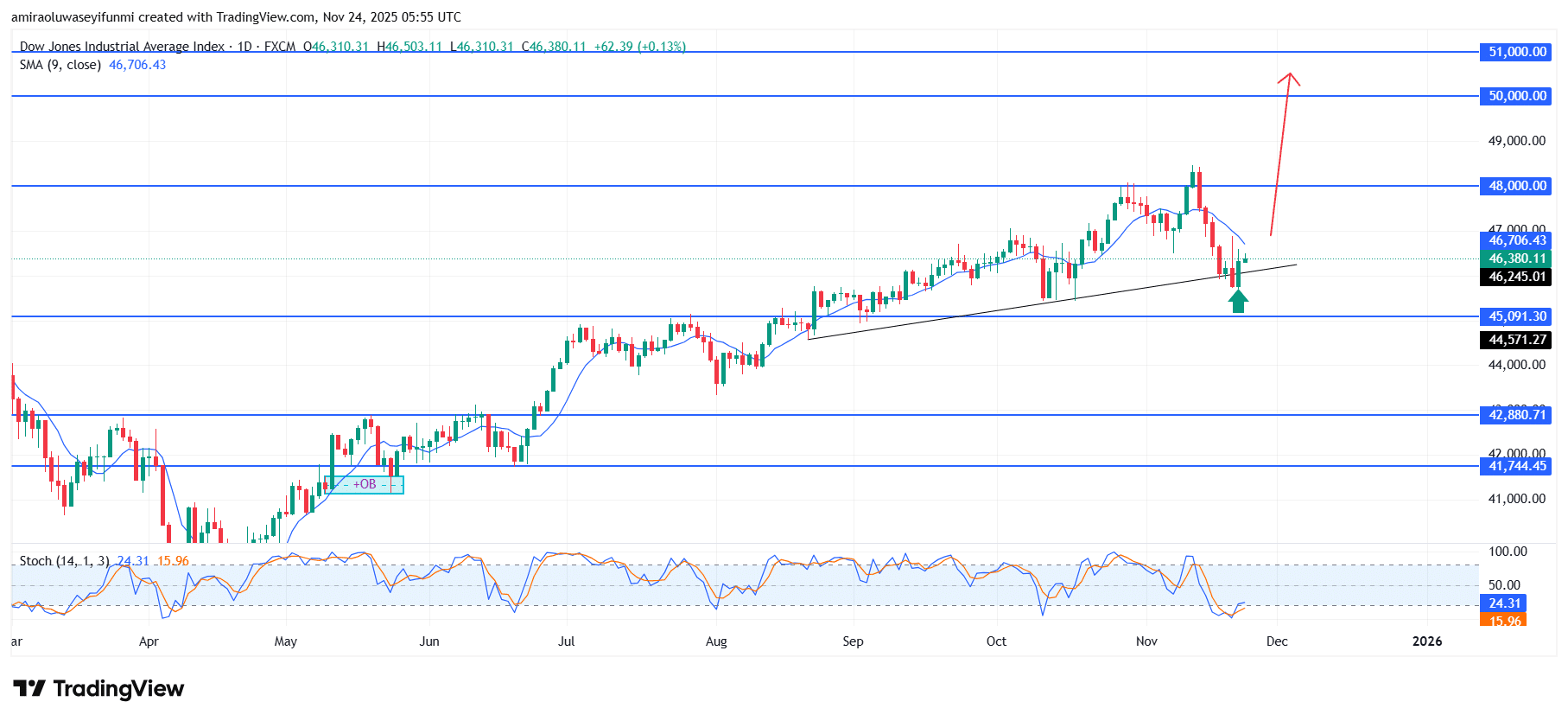

US30 is poised for renewed upside momentum. The index is presenting a constructive recovery pattern as price action aligns with supportive indicators, particularly the short-term moving average, which has begun to stabilize after the latest pullback. The Stochastic Oscillator has crossed upward from oversold territory, indicating renewed buying interest and the potential continuation of the broader bullish structure. This combination reflects a market environment where dip-buying behaviour is returning, reinforcing the prevailing upward bias.

US30 Key Levels

Resistance Levels: $48000, $50000, $51000

Support Levels: $45090, $42880, $41740

US30 Long-Term Trend: Bullish

From a technical perspective, the index has respected the ascending trendline around $46,250, where buyers stepped back into the market with conviction. This rebound has also held above the key support zone at $45,090, maintaining structural strength despite recent volatility. Price is now moving back toward the short-term moving average near $46,700, a level that, if surpassed, could pave the way for a retest of the immediate resistance around $48,000.

Looking ahead, the broader outlook remains upward-biased as long as the trendline support continues to hold. A decisive break above $48,000 would likely accelerate bullish momentum toward the psychological level at $50,000, with an extended target at $51,000 if buying pressure intensifies. Market sentiment and technical alignment suggest the index is preparing for a steady continuation into higher valuation zones.

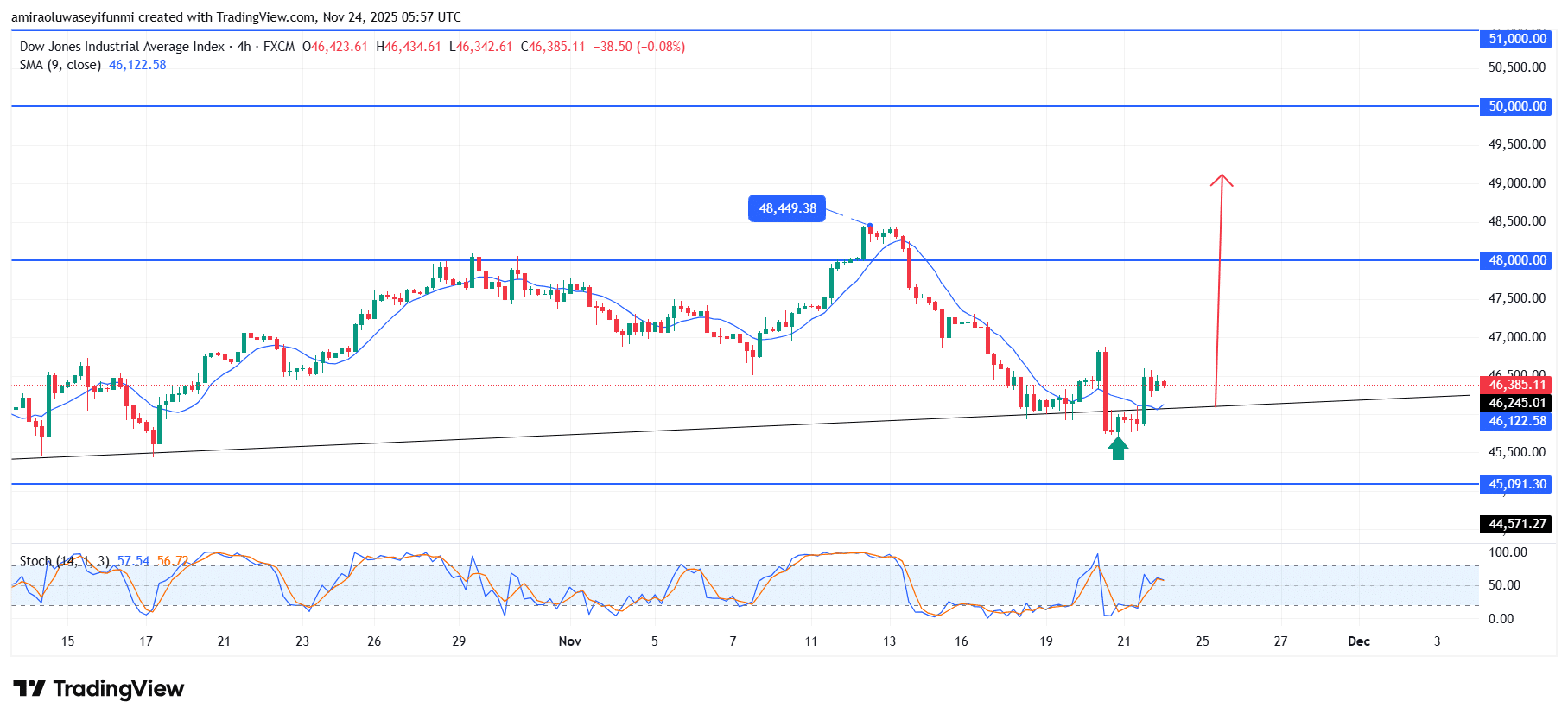

US30 Short-Term Trend: Bullish

US30 continues to show bullish intent on the four-hour chart as price rebounds strongly from the ascending trendline near $46,250. The upward cross on the Stochastic indicator signals renewed buying momentum following the recent corrective phase. Price is stabilizing above the 9-period SMA at $46,120, indicating that short-term sentiment is shifting back in favour of buyers. A break above the $48,000 resistance zone could open the path toward higher objectives around $50,000, aligning with expectations supported by forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.