Forex markets tend to stay in a tight range in today’s session. The dollar rallied moderately, even as Fed Chairman Jerome Powell opposed the cancellation of the stimulus. The yen is also strengthening, while commodity currencies are slightly lower. At the end of the week, the pound sterling remains the strongest, followed by the Canadian.

The euro is the worst. The sale of the euro may continue until the end of the week. The widespread decline in the euro continues today, putting pressure on the Swiss franc and, to a lesser extent, on the pound sterling. The profitability of the Italian bench is growing rapidly due to the increased risk of new elections in the summer.

On the other hand, commodity currencies continue to be strong, fueled by an overall firm attitude towards risk. This week, global stocks are taking a breather in consolidation. The dollar and the yen are currently mixed, with the dollar is dominating.

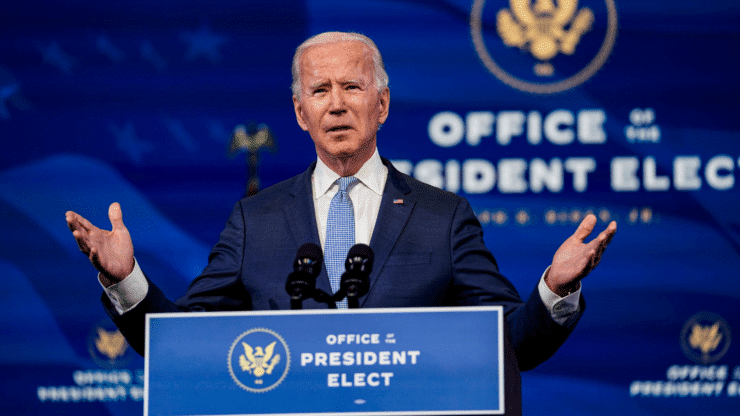

President-elect Joe Biden outlined his $1.9 trillion budget package. The package includes $1 trillion in direct aid to households and checks for $1,400 in addition to checks for $600 as part of the latest Congressional incentive. $440 billion will be used for small businesses and communities. $415 billion will be spent on virus control and vaccine introduction.

It was a relatively calm week for the euro. Currently, the EUR/USD pair is trading at 1.2124, down 0.25% over the day. Technically, the break of 1.2131 of the EUR/USD pair suggests that the correction from 1.2348 has resumed. While a deeper pullback can be seen, we expect strong support from 1.2058 to contain the decline.

The ECB released the minutes of its December meeting on Thursday. The news hasn’t shaken the euro, but it may provide some insight into what we can expect when the ECB holds its first policy meeting of the year next week.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.