The US Dollar recorded a notable comeback last week after speculation of a more aggressive Fed tightening policy by market participants intensified on the heels of hawkish statements from Fed policymakers.

Reports show that the currencies market is pricing in a 70% chance of the Fed interest rate jumping to 1.50 – 1.75% by the end of June. That said, this sentiment sent the stocks and cryptocurrency markets tumbling significantly, with DOW recording its worst trading session since 2020 on Friday.

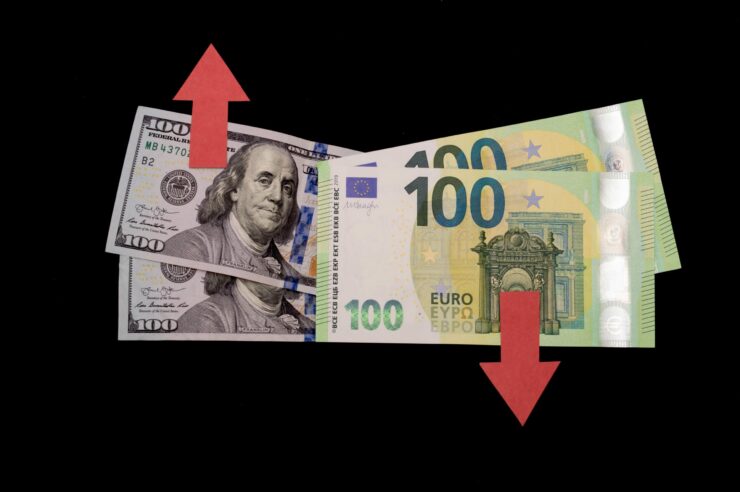

US Dollar Lead Currency Market in Gains

In the Forex market, the dollar came on top as the best performer amid market Fed expectations and risk flight by investors. Euro came behind the dollar in performance last week after ECB members ruminated on the possibility of a rate hike in July. Risk-loving currencies like Aussie and Kiwi recorded the worst performance as capital funneled out of risky assets to safe-haven currencies and assets. Finally, the Japanese yen remained in a range-bound consolidation, while European majors and Loonie traded on mixed sentiments.

Analysts opined that Fed policymakers need to come to a consensus on the need to “front-load” some portion of the rate hikes to hasten market normalization afterward. They argued that whether interest rates ended up at 2.5% or 3.5% by year’s end depended on future market data and developments. However, rate hikes have to come faster and earlier.

That said, traders increased their trading bets on a 50 basis points (bps) rate hike by the Federal Reserve in May after several policymakers, including Chair Jerome Powell, said it was “on the table.” Fed fund futures traders have priced in a 99.6% chance of a 75 – 100% rate hike, compared to 66% last month.

As mentioned earlier, riskier markets like stocks and cryptocurrency fell sharply last week as traders reacted aggressively to the increased Fed tightening sentiment.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.